Another Argument For Owning vs. Renting

It May Be A Tired Argument But...

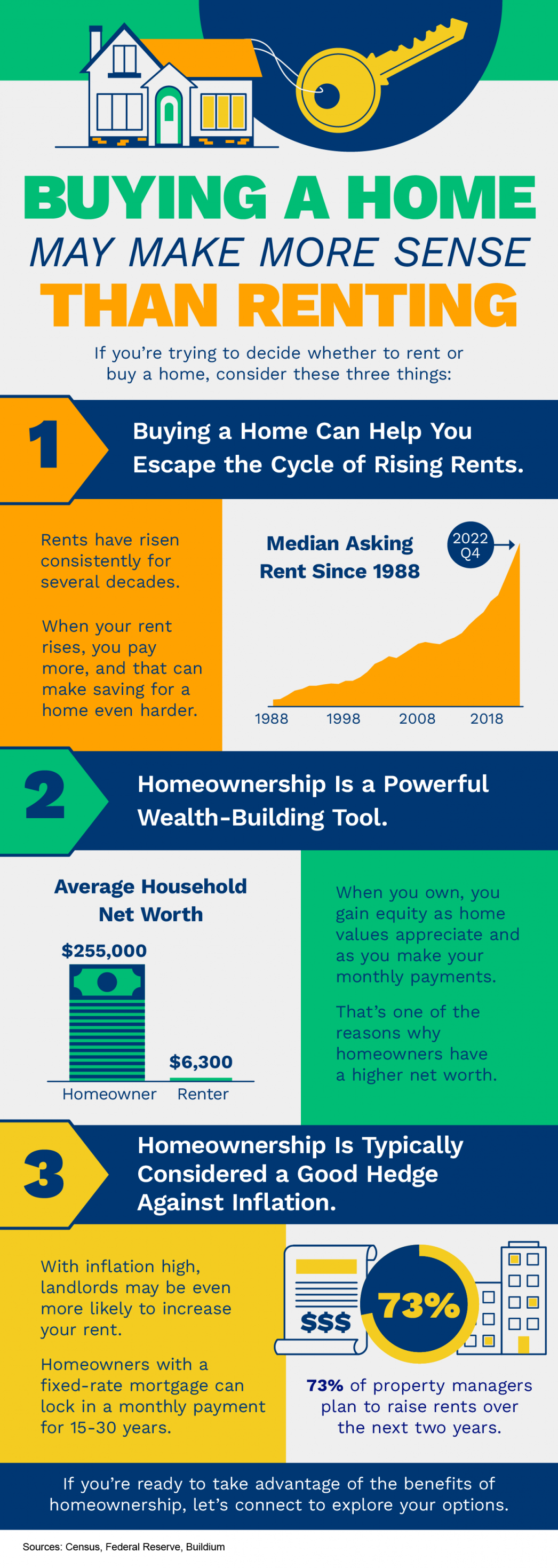

Renting vs. owning is a topic that has been debated for ages. While it may seem like paying rent is simply paying someone else's mortgage, there's actually much more to it than that. As a renter, you are not only paying for your landlord's mortgage, but also for a laundry list of other expenses. In today's blog, we'll break down exactly what those expenses are and why they should be taken into consideration when deciding whether to rent or own.

Utilities

First and foremost, let's talk about utilities. As a renter, you may not realize that the state of the home you're renting can have a significant impact on your utility bills. If the home is poorly insulated or has an inefficient heating system, you'll end up paying more in utilities. The same goes for outdated windows. These costs are often passed on to the tenant in some way, whether it be through higher rent or a separate utility bill.

Maintenance

Maintenance is another factor to consider. When you own a home, you're responsible for all maintenance and repairs. But as a renter, you're still responsible for a portion of those costs. In fact, a typical maintenance budget for a rental property is around 10% of the gross rent. This could be for anything from fixing a leaky faucet to replacing a broken appliance.

Property Management

Property management is another expense that you may not realize you're paying for as a renter. While some landlords may handle property management themselves, others hire dedicated property managers. This can cost anywhere from 8-15% of gross rents, depending on the services offered.

Capital Expenditures

Capital expenditures are another expense that landlords have to factor into the cost of rent. This includes any major updates or repairs that the property may need, such as a new roof or updated plumbing. Like maintenance, this can cost around 10% of the gross rent.

Vacancy

Vacancy is also a consideration for landlords when setting rent prices. Even the best rental properties will experience vacancies at some point. To account for this, landlords typically budget for a certain number of weeks or months per year that the property may be vacant. A safe number to budget for here is around 5% of gross rent.

Insurance

Insurance is another expense that landlords have to factor in. Landlord insurance can be much more expensive than typical homeowner's insurance, sometimes as much as 2-3 times the cost. On average, it's safe to budget around $600 per year per apartment in a building.

Taxes

Taxes are yet another expense that landlords have to pay. This can be a highly variable number, and is often higher for multifamily buildings than single family homes. In Maine, the average property tax as a percentage of property value is around 1.2%.

Mortgage

Of course, landlords also have to factor in their mortgage payments when setting rent prices. This, along with insurance and taxes, can vary greatly depending on the property.

Profit

Finally, landlords need to make a profit. After factoring in all of these expenses, many landlords may only make a couple hundred dollars in realized profit each month.

Final Thoughts...

As you can see, there are a lot of expenses that go into what you pay for rent. For some, the convenience and lack of responsibility that comes with renting may be worth the cost. However, if you're looking to build wealth and increase your net worth, owning a home may be a better option. As seen in the infographic above, the average household net worth of a homeowner is significantly higher than that of a renter.

If you're considering making the switch from renting to owning, it's worth having a conversation to explore your options. As a real estate agent, I'd love the opportunity to empower you on your path to homeownership.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts