How Does Inflation Impact The Housing Market?

It's no secret that inflation influences various economic sectors, including the housing market. But how exactly does this relationship work, and what does it signify for potential home buyers and sellers?

Let's delve into the intricate dance between inflation and the housing market, and see what the latest data suggests.

The Dance Between Housing And Overall Inflation

Shelter inflation, a term that perhaps not everyone is familiar with, is essentially the price growth pertaining exclusively to the housing sector. It is gauged through a meticulous survey conducted by the Bureau of Labor Statistics (BLS), collecting data from both renters on their current rent and homeowners on their estimated rental value of their homes.

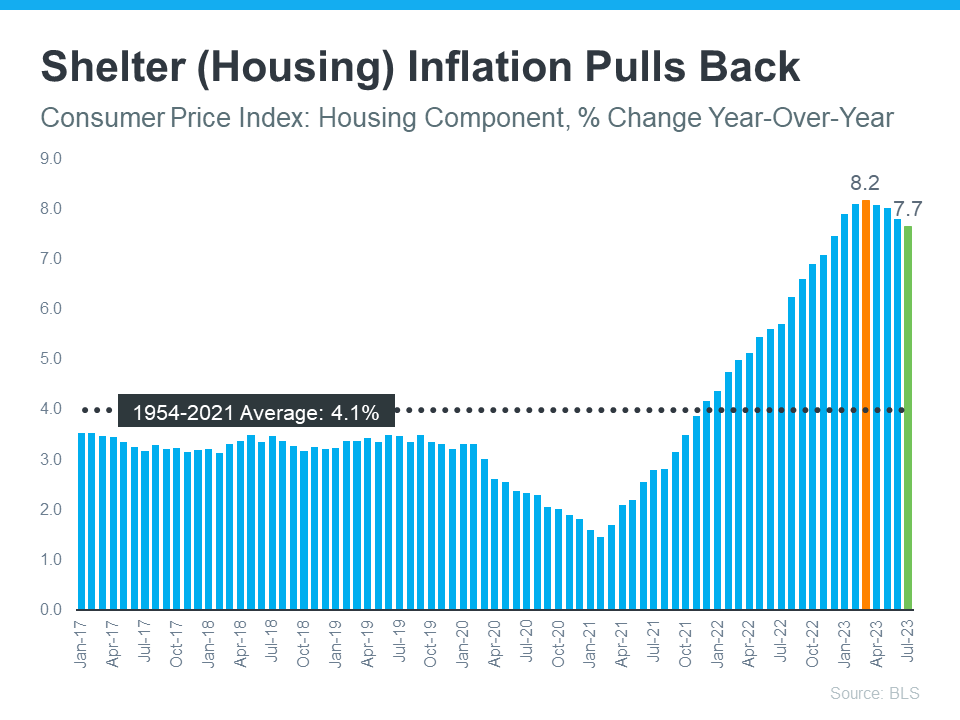

Just as general inflation tracks the price variations of daily necessities, shelter inflation monitors housing cost dynamics. The encouraging news is, for four consecutive months, this metric has been on a downward trajectory, as depicted in the graph below:

Why is this trend significant? Considering that shelter inflation contributes to about one-third of the overall inflation computed via the Consumer Price Index (CPI), a decrease in shelter inflation generally heralds a reduction in overall inflation. Consequently, the recent dip might be a precursor to a potential decrease in inflation in the coming months, providing a respite to the Federal Reserve that has been striving to control inflation since early 2022.

Inflation And The Federal Reserve's Strategy

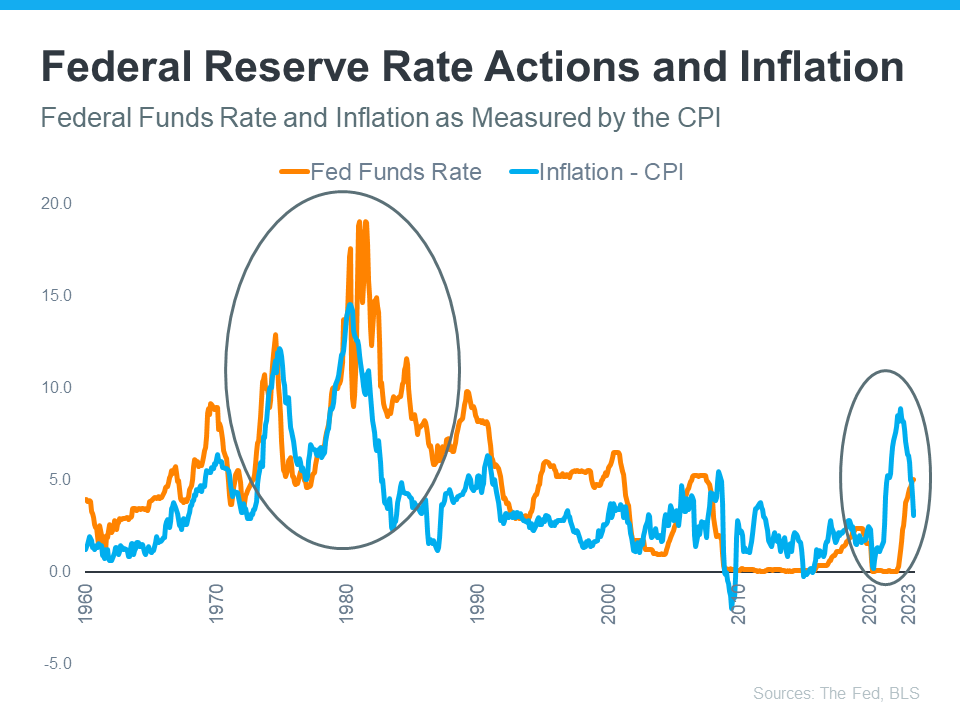

The Federal Reserve has actively responded to inflation surges by raising the Federal Funds Rate, influencing the borrowing costs among banks. The aim? To prevent the economy from spiraling due to inflation. The subsequent graph illustrates this correlation:

We can observe the Federal Reserve's strategy to maintain the inflation rate around their 2% benchmark, especially in the circled segment highlighting the recent spike in inflation and the responsive actions taken to stabilize it.

Could We Witness Favorable Mortgage Rates Soon?

While it remains a speculation, the current trends in inflation dynamics offer a silver lining, hinting at the possibility of a decrease in mortgage rates, as Mortgage Professional America (MPA) explains:

“. . . mortgage rates and inflation are connected, however indirectly. When inflation rises, mortgage rates rise to keep up with the value of the US dollar. When inflation drops, mortgage rates follow suit.””

Though forecasting the exact future trajectory of mortgage rates remains a challenge, the signs of declining inflation are certainly a hopeful indicator.

Bottom Line

Understanding the symbiotic relationship between inflation and the housing market is vital, whether you plan to buy, sell, or keep abreast of the market pulse. To navigate these complex dynamics and make informed decisions, let's connect and equip you with the insights you need.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts