The Real Story Behind The 2023 Home Price Predictions

Last year, there was a whirlpool of media predictions insisting that 2023 would witness a significant plummet in home prices, brewing anxiety and raising questions of a possible echo of the 2008 housing crash. However, these projections largely missed the mark.

Indeed, following the extravagant home price surge during the “unicorn” years, there has been a moderation rather than a crash. Remarkably, the housing market has showcased much more stability than anticipated, proving many predictions wrong.

Let’s compare the early forecasts to the updated insights that the experts are now presenting.

Expert Home Price Projections: A Comparative Insight

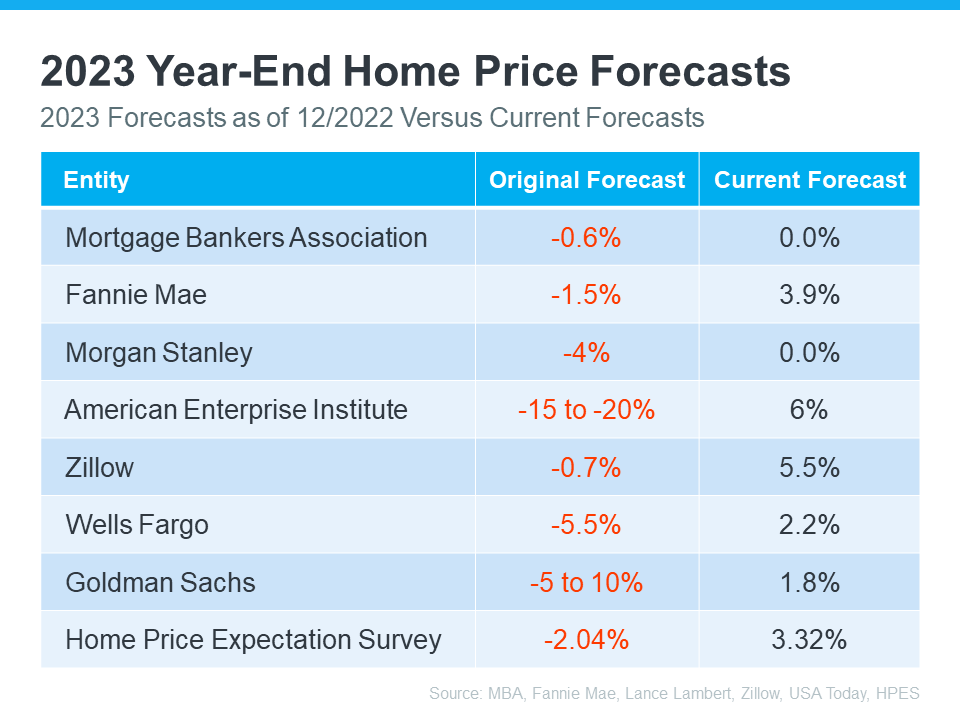

Illustrated in the ensuing chart, we observe the 2023 home price estimates from seven reputed agencies, juxtaposing the initial forecasts made in late 2022 with the revamped projections crafted recently.

Notably, every initial forecast indicated a dip in home prices, depicted in red in the central column. Yet, a shift in stance is apparent in the recent updates, with experts leaning towards stable or even positive growth by year-end, replacing the previously anticipated decline.

Attributing to the endurance of home prices, Odeta Kushi, Deputy Chief Economist at First American, asserts:

“One thing is for sure, having long-term, fixed-rate debt in the U.S. protects homeowners from payment shock, acts as an inflation hedge - your primary household expense doesn't change when inflation rises - and is a reason why home prices in the U.S. are downside sticky.”

Looking Ahead: Preparing For Future Headlines

Anticipating a continued misrepresentation in media narratives concerning home prices, it becomes essential to remain informed and discerning. The upcoming reports may overlook the seasonal nature of home price evolution, presenting a distorted picture.

Traditionally, as we approach year-end, a slowing momentum in the housing market is observed, accompanied by a decreased pace in home price growth. It is vital to recognize that this deceleration does not equate to a decrease in home prices but represents a stabilized growth pattern.

The Key Takeaway

Headlines can sometimes distort reality. Despite last year's fearful anticipation of a dramatic fall in home prices, the market remained steadfast. Stay connected to receive trustworthy insights and to differentiate between the reality and the misrepresented facts through credible data.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts