How Home Prices Are Defying Negative Predictions

In today's news cycle, you may be feeling a bit of unease about the current state of home prices, questioning if the worst is yet to come. Such anxiety stems from today's headlines often depicting an overly negative narrative. However, when we compare the year-over-year data, it's true that home prices have experienced a slight drop. But this is largely due to last year's unprecedented "unicorn" surge in home prices, which skewed the normal market conditions.

To gain a more balanced view, it's important to focus on monthly data instead, which suggests a decidedly more positive trend. It's crucial to remember that housing market trends can vary significantly from one locale to another, but the national data paints an encouraging picture.

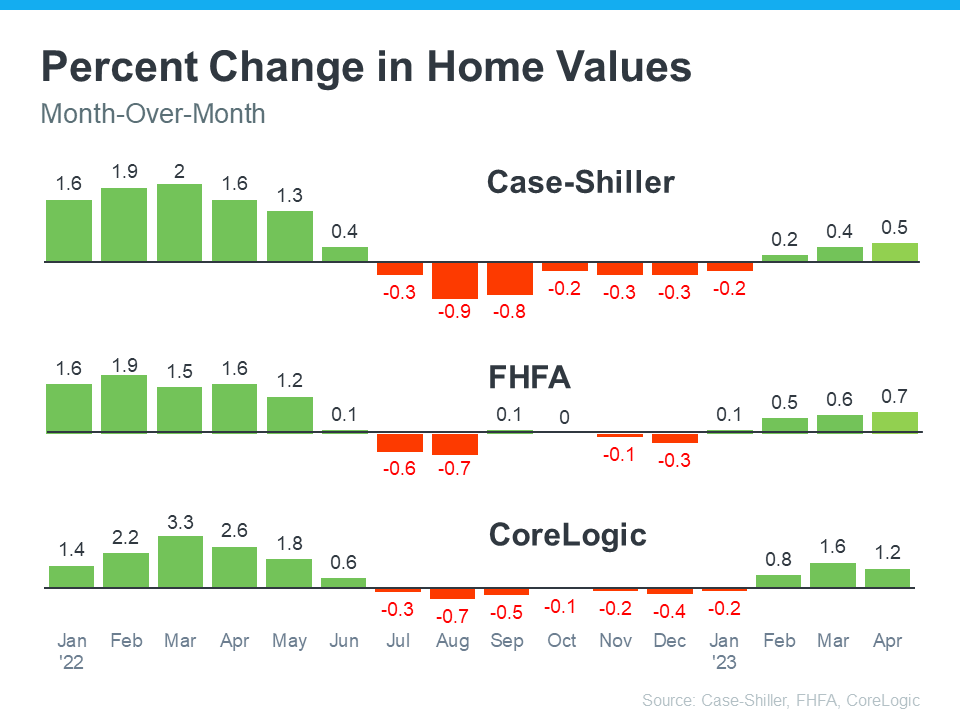

The graphs below, derived from recent monthly reports from three distinct sources, demonstrate that the most substantial home price declines are behind us, and that prices are showing signs of national appreciation.

Upon examining this monthly data, we can segment the past year in the housing market into two distinct periods. In the first half of 2022, home prices rose rapidly. However, from July onwards, prices started to decline (illustrated in red). By August or September, the trend began to stabilize. Most importantly, the most recent data for early 2023 shows that home prices are on an upswing.

The consistent upward trend in prices over the past three months, as indicated in all three reports, is a positive sign for the housing market. This month-over-month data suggests a national shift is in progress – home prices are rebounding.

Craig J. Lazzara, Managing Director at S&P Dow Jones Indices, discusses home price trends, stating:

“If I were trying to make a case that the decline in home prices that began in June 2022 had definitively ended in January 2023, April’s data would bolster my argument.”

Many experts believe that home prices didn't plummet as some had predicted primarily due to a scarcity of available homes relative to the number of interested buyers. Despite today's mortgage rates, the number of people eager to buy exceeds the number of homes on the market.

Mark Fleming, Chief Economist at First American, elaborates on how this imbalance maintains an upward pressure on prices:

“History has shown that higher rates may take the steam out of rising prices, but it doesn’t cause them to collapse entirely. This is especially true in today’s housing market, where the demand for homes continues to outpace supply, keeping the pressure on house prices."

Doug Duncan, Senior VP and Chief Economist at Fannie Mae, attests that robust demand is driving home price growth beyond expectations:

“. . . housing prices continue to show stronger growth than what was previously expected . . . Housing’s performance is a testimony to the strength of demographic-related demand . . .”

So, What Does This Mean For You?

- For Buyers: If you've been holding off on purchasing a home due to fears of a potential decrease in home values, the recent recovery in home prices should be a welcome reassurance. This recovery also presents the opportunity to invest in an asset that generally appreciates over time.

- For Sellers: If you've been hesitant to list your house due to concerns about fluctuating home prices affecting its value, it might be time to collaborate with a real estate agent. You no longer need to hold off, as the latest data suggests that the market is shifting in your favor.

Bottom Line

If concerns about a potential drop in home prices have caused you to delay your moving plans, the most recent data reveals that the worst is over, and prices are appreciating nationally. Get in touch with us so we can provide you with the latest updates on home prices in our local area.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts