What's Ahead For Mortgage Rates? A Deep Dive Into Economic Indicators

If you're monitoring mortgage rates because you recognize their impact on your borrowing expenses, you might be contemplating what the future holds for them. Unfortunately, predicting mortgage rates is notoriously challenging.

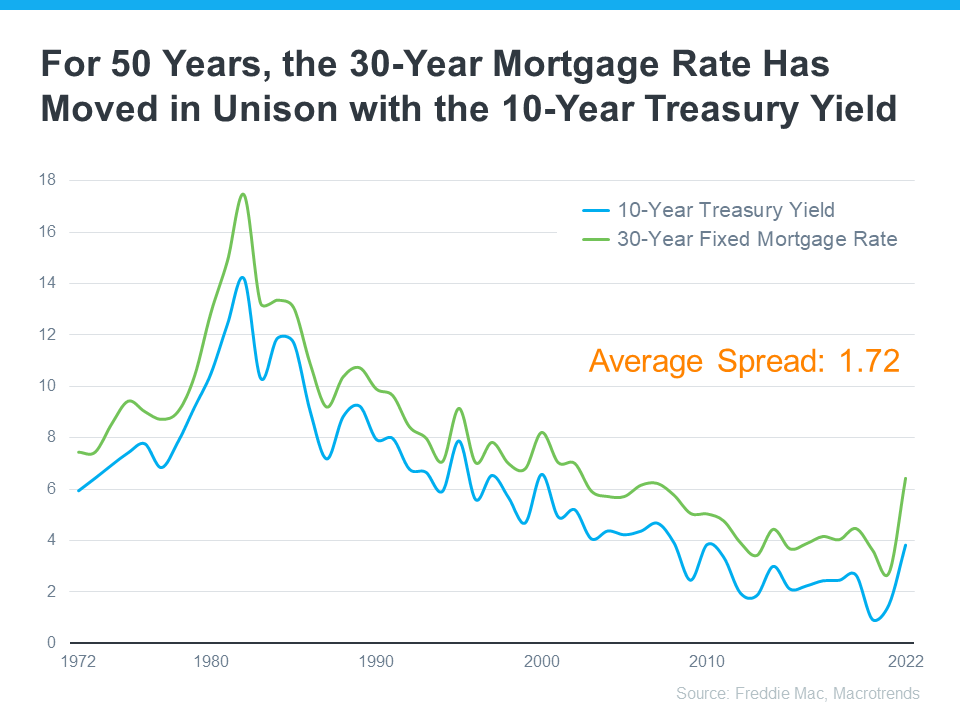

However, history provides a reliable indicator of rate movements, namely the relationship between the 30-Year Mortgage Rate and the 10-Year Treasury Yield. Here's a chart depicting these two metrics since Freddie Mac began maintaining mortgage rate records in 1972:

As the chart illustrates, the average difference between the two over the last 50 years has been 1.72 percentage points (or 172 basis points). If you observe the trend line, you can see that when the Treasury Yield ascends, mortgage rates typically react accordingly. Conversely, when the Yield descends, mortgage rates tend to follow suit. While they generally move in tandem, the gap between the two has stayed around 1.72 percentage points for a considerable duration. However, it's crucial to observe that this spread is recently expanding far beyond the norm:

You might be asking: what's causing the spread to exceed its usual average? The primary reason is the uncertainty prevalent in the financial markets. Elements such as inflation, other economic triggers, and the policies and decisions of the Federal Reserve (The Fed) all influence mortgage rates and an expanding spread.

So, Why Is This Important To You?

Although this may seem overly technical and detailed, here's why potential homebuyers like you should understand the spread. It suggests that, based on the typical historical gap between the two, there's potential for mortgage rates to improve today.

Experts believe that this improvement is forthcoming, provided inflation continues to moderate. As explained by Odeta Kushi, Deputy Chief Economist at First American:

"It's reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal... However, it's unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay."

Similarly, a Forbes article mentions:

"Though housing market observers expect mortgage rates to remain elevated amid ongoing economic uncertainty and the Federal Reserve's rate-hiking war on inflation, they believe rates peaked last fall and will decline—to some degree—later this year, barring any unforeseen surprises."

Bottom Line:

If you're either a first-time home buyer or a current homeowner contemplating moving into a home that better fits your current requirements, stay updated on what's happening with mortgage rates and what experts predict for the coming months.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts