Adjusting To The New Normal: How Mortgage Rates Shape Buyer Behavior

Before you proceed to list your house for sale, having a grasp of the current housing market climate is crucial. A positive development to note is that homebuyers are adjusting to the prevailing mortgage rates, perceiving them as the new standard.

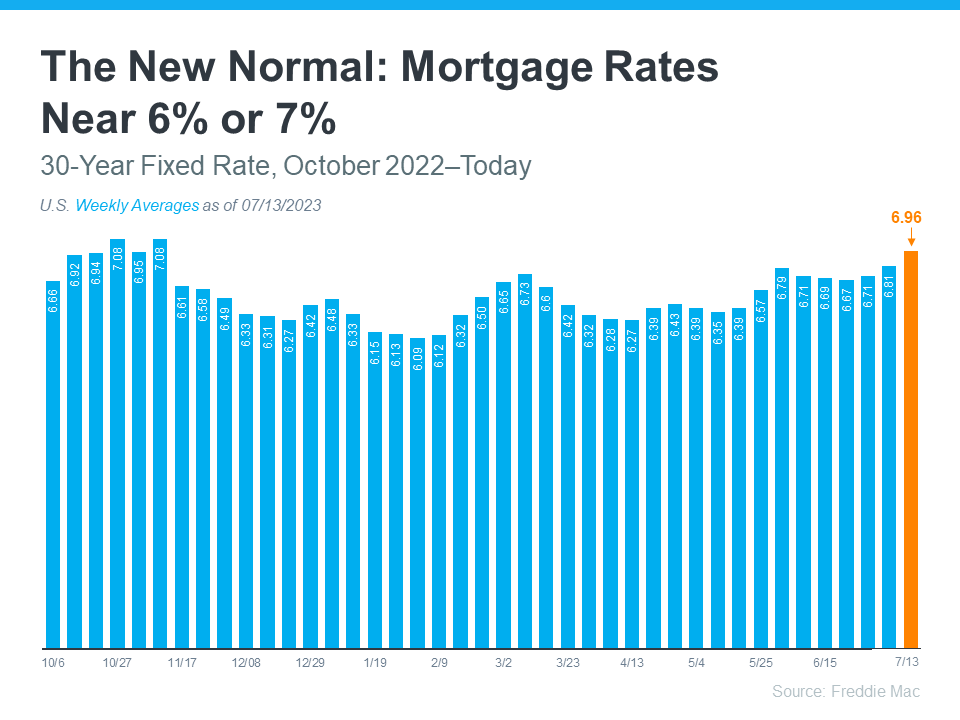

To appreciate the recent trends in mortgage rates, the graph below traces the trajectory of the 30-year fixed mortgage rate from Freddie Mac since the previous October. As evident, rates have remained fairly consistent between 6% and 7% over the past nine months.

Lawrence Yun, the Chief Economist at the National Association of Realtors (NAR), emphasizes that mortgage rates are instrumental in shaping buyer demand and, consequently, home sales. Yun underscores the beneficial effects of steady rates:

"Mortgage rates heavily influence the direction of home sales. Relatively steady rates have led to several consecutive months of consistent home sales."

For a seller, the news that home sales are maintaining consistency is encouraging. It signifies that buyers are actively looking for and purchasing homes. Let's delve a bit deeper into how mortgage rates have recently influenced demand.

When mortgage rates experienced a sharp rise last year, rocketing from roughly 3% to 7%, a large number of potential buyers were taken aback and decided to postpone their home buying plans. However, as time has progressed, this initial surprise has subsided. Buyers are becoming more comfortable with the present mortgage rates and have come to terms with the fact that the era of record-low rates has passed. As noted by Doug Duncan, SVP and Chief Economist at Fannie Mae:

". . . consumers are adapting to the idea that higher mortgage rates will likely stick around for the foreseeable future."

Interestingly, a recent survey conducted by Freddie Mac discloses that 18% of respondents are likely to purchase a home within the next six months. This implies that nearly one in five people surveyed intend to buy in the near future, suggesting that buyers will remain active in the upcoming months.

However, it's important to remember that mortgage rates aren't the only factor affecting buyer demand. Regardless of where mortgage rates stand, individuals will always have reasons to move, be it due to job relocation, changes in family circumstances, or other personal factors. As a seller, you can be confident that there's a market for your house today. Moreover, with buyers adjusting to the current rates, the demand remains robust.

Bottom Line

The perception of today's mortgage rates among buyers is changing – they're adjusting to the new normal. Stable rates are contributing to strong buyer demand and sustained home sales. Let's connect so we can list your house on the market and attract these potential buyers.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts