Are We On The Brink Of A Foreclosure Crisis

With the soaring costs in essentials like groceries and fuel, there's mounting speculation: will homeowners struggle with their mortgage payments, leading to a surge in foreclosures? Despite a slight increase in foreclosure filings from last year, industry experts are dismissing fears of an impending foreclosure wave.

Housing market expert, Bill McBride of Calculated Risk, predicted the 2008 foreclosure crisis after intensive data scrutiny. Applying the same rigor to today's market dynamics, McBride offers reassurance:

“There will not be a foreclosure crisis this time.”

So, why is another large-scale foreclosure unlikely now?

Few Homeowners Are Struggling With Mortgage Payments

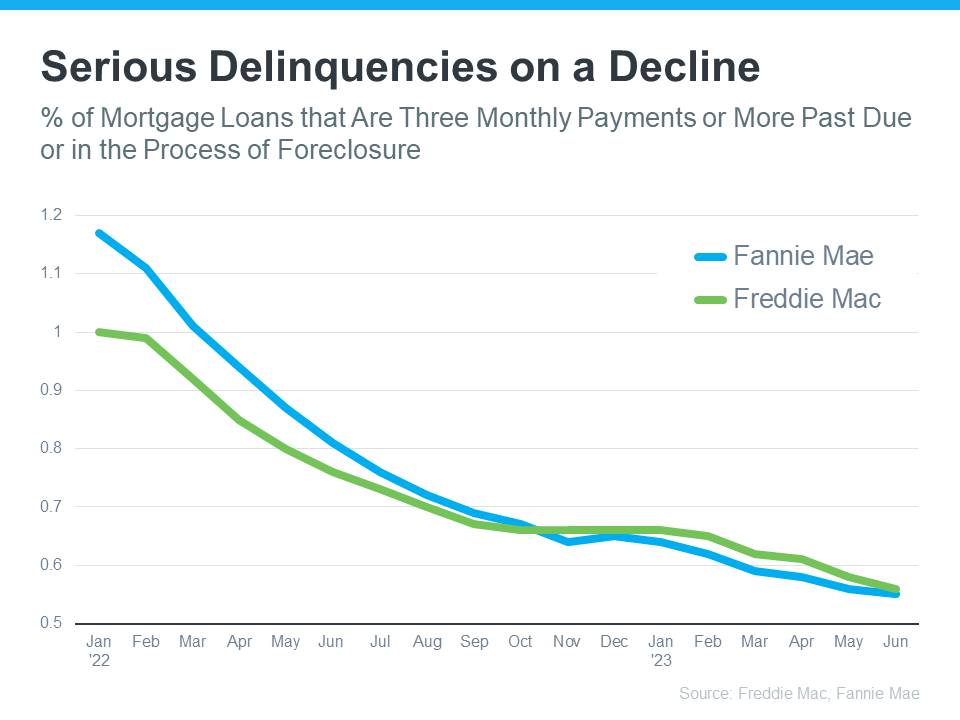

During the last housing downturn, lenient lending practices allowed many to secure mortgages, regardless of their financial capacity to sustain repayments. Today's stringent lending criteria means mortgages are primarily granted to those with proven repayment capability. In contrast to the past, there's a significant decline in homeowners who are seriously lagging in their payments, as evidenced by data from Freddie Mac and Fannie Mae.

CoreLogic's Principal Economist, Molly Boese, elaborates on the current homeowners' consistency in meeting mortgage commitments:

“May’s overall mortgage delinquency rate matched the all-time low, and serious delinquencies followed suit. Furthermore, the rate of mortgages that were six months or more past due, a measure that ballooned in 2021, has receded to a level last observed in March 2020.”

For a major upswing in foreclosures to materialize, there would need to be a considerable spike in mortgage payment defaults. With a majority of homeowners consistently meeting their obligations, a large-scale foreclosure scenario is improbable.

Conclusion:

Concerned about a looming foreclosure deluge? The current data provides no basis for such apprehensions. Instead, it reflects that most mortgage holders today are financially sound and consistent in their repayments.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts