Leverage Your Current Home To Buy Your Next

As a homeowner, you have the unique opportunity to build equity over time as you live your life. When life changes and your home is no longer working for you, it may be time to leverage your equity towards buying a new home. Before you can take advantage of this, it's important to understand what equity is and how it grows. Bankrate defines equity as:

“Home equity is the portion of your home you’ve paid off – in other words, your stake in the property as opposed to the lender’s. In practical terms, home equity is the appraised value of your home minus any outstanding mortgage and loan balances.”

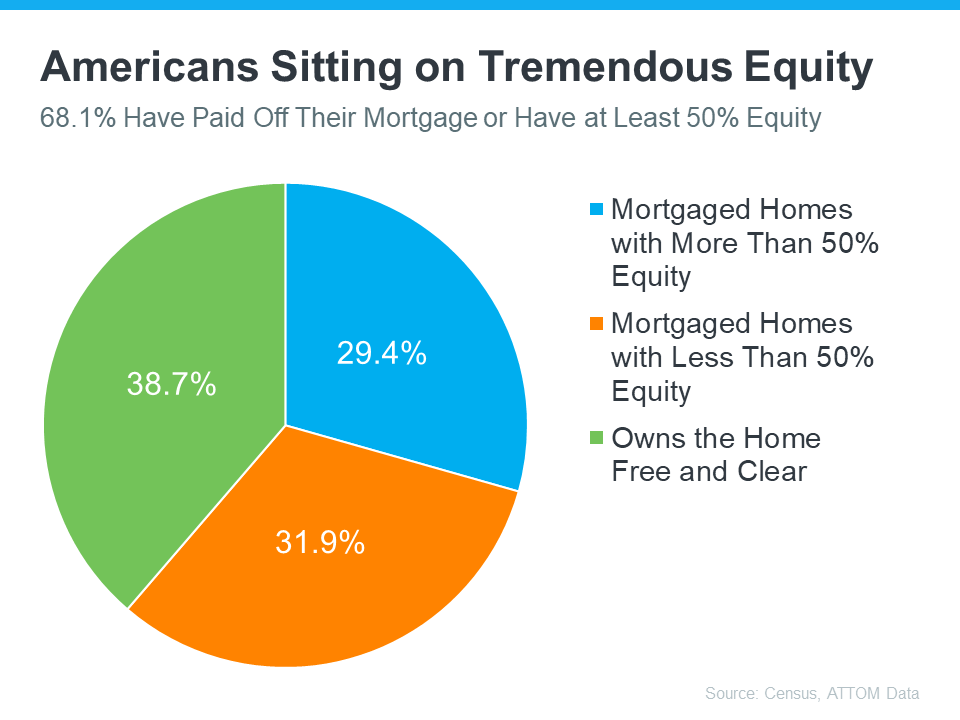

Most Americans Have Substantial Equity

If you have owned your home for some time, it's likely that you've accumulated some equity - and you may not even be aware of how much. According to data from the U.S. Census Bureau and ATTOM, the majority of Americans have a significant amount of equity (refer to the graph below).

Having such substantial equity is a benefit to homeowners in more ways than one. Rick Sharga, Executive Vice President of Market Intelligence at ATTOM, explains:

"Record levels of home equity provide security for millions of families, and minimize the chance of another housing market crash like the one we saw in 2008."

Your home equity grows over time. Aside from providing financial stability while you own your home, selling your home and utilizing your equity can go a long way toward financing your next home, even if it means buying into a higher interest rate.

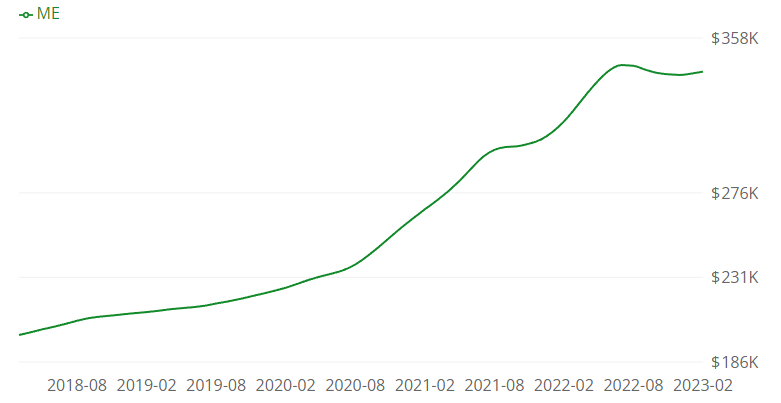

Maine’s Real Estate Market

In Maine, the average home price is about $340,000 and it's still a seller's market. Well priced, move in ready homes are being sold for more than their listing price, and it's difficult for buyers to find homes within their budget. In a market like this, having substantial equity can be a significant advantage for a homeowner looking to sell their current property and purchase a new one.

Utilizing Your Equity To Buy Your Next Home

By selling your home and leveraging your equity, it can be easier to pay for your next home. You can use your equity as a down payment on your next home, potentially reducing your monthly mortgage payments. By connecting with a trusted real estate professional, you can learn more about the equity you've built in your home and begin planning your next move.

If you're considering utilizing your home equity to purchase your next home, don't hesitate to reach out to me. I can help guide you through the process and ensure that you make the most of your most cherished investment.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts