Maine's Real Estate Resilience: Dispelling The Myths Of A Market Crash

Last year's final quarter was filled with doomsday predictions about a potential crash in home prices. Renowned financial experts and institutions like Jeremy Siegel from the Wharton School of Business, Mark Zandi, Chief Economist at Moody's Analytics, and Goldman Sachs all had ominous forecasts:

“I expect housing prices fall 10% to 15%, and the housing prices are accelerating on the downside.”

Zandi chimed in with this doozy:

"Buckle in. Assuming rates remain near their current 6.5% and the economy skirts recession, then national house prices will fall almost 10% peak-to-trough. Most of those declines will happen sooner rather than later. And house prices will fall 20% if there is a typical recession.”

Goldman Sachs issued their prediction, too:

“Housing is already cooling in the U.S., according to July data that was reported last week. As interest rates climb steadily higher, Goldman Sachs Research’s G-10 home price model suggests home prices will decline by around 5% to 10% from the peak in the U.S. . . . Economists at Goldman Sachs Research say there are risks that housing markets could decline more than their model suggests.”

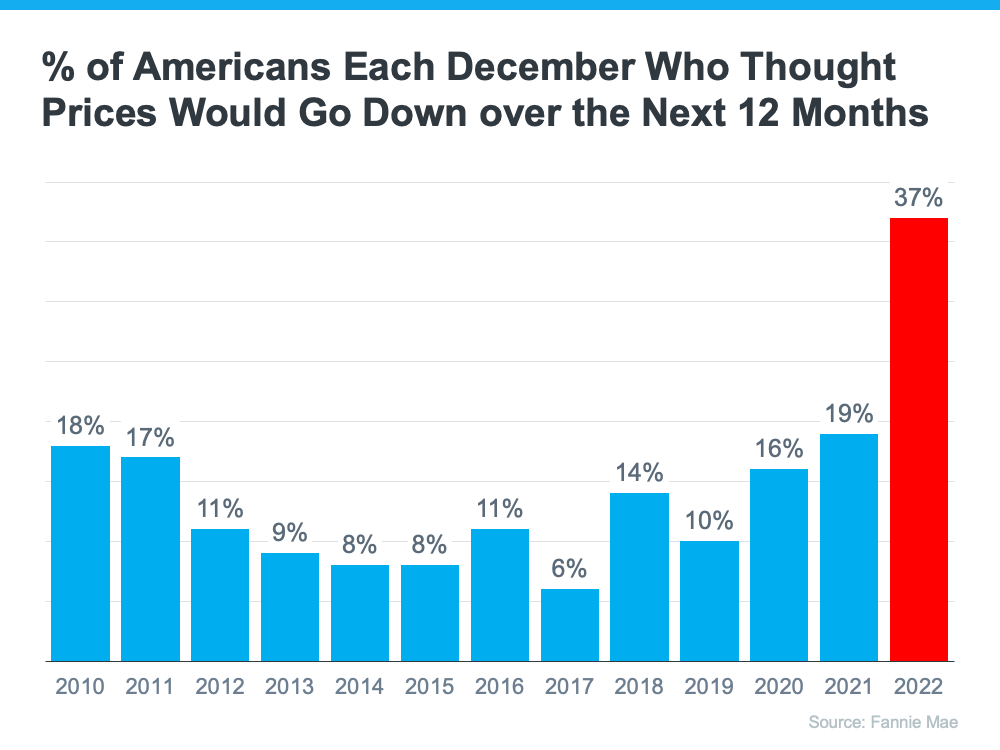

The Downside To These Predictions: Consumer Confidence Shaken

These forecasts not only alarmed many consumers but also shook their confidence in the residential real estate market. Fannie Mae's December Consumer Confidence Survey captured this sentiment perfectly. A larger percentage of Americans than ever before anticipated home prices to fall in the following 12 months. Such expectations prompted hesitation among potential buyers and sellers entering the new year.

The Silver Lining: Home Prices Remained Steady

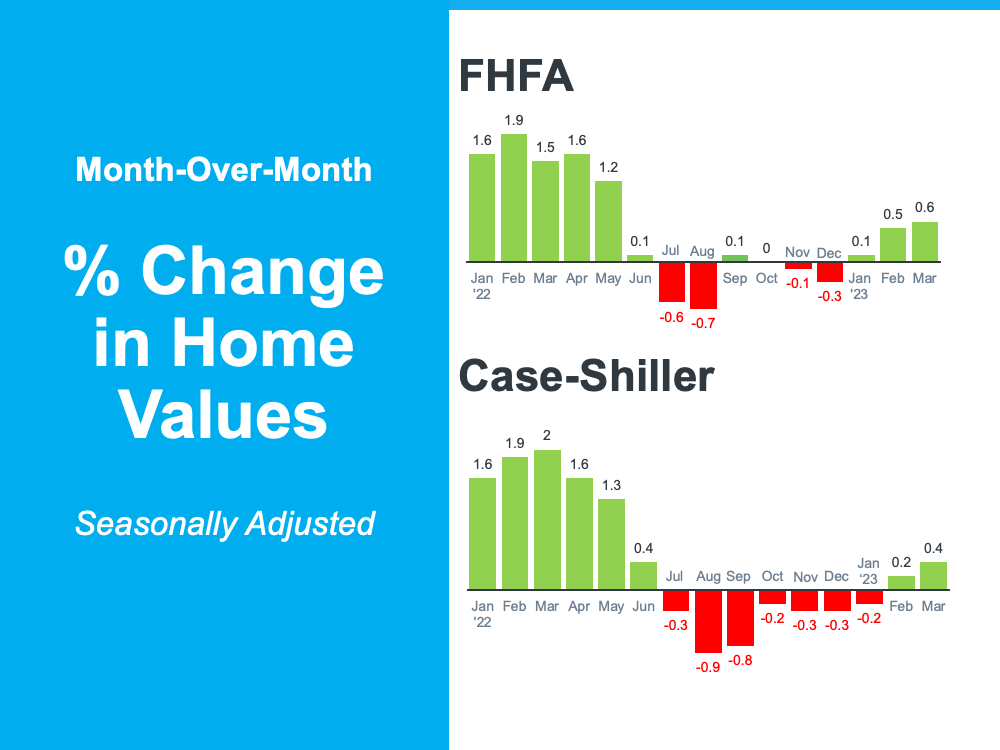

Contrary to the grim predictions, home prices seem to be bouncing back from the minimal depreciation experienced in the past few months.

A recent report from Goldman Sachs explains,

“The global housing market seems to be stabilizing faster than expected despite months of rising mortgage rates, according to Goldman Sachs Research. House prices are defying expectations and are rising in major economies such as the U.S. . . . ”

This assertion is supported by the recent data from two of the most reputable indexes on home prices: Case-Shiller and the FHFA.

What does this mean for Maine's real estate market, especially York and Cumberland counties?

Let's not forget that even amid these nationwide forecasts, Maine's housing market demonstrated considerable resilience. As of September 2022, median home prices in Maine were up by 7.4% compared to the previous year1. Cumberland County specifically saw a 10.4% increase in home prices compared to last year, with the median sale price reaching $530K2.

Moreover, the housing supply remains historically low, further bolstering home prices. The inventory of unsold existing homes nationwide stood at 3.2 months in September 20221.

These trends suggest that the Maine real estate market, particularly in the York and Cumberland counties, has been largely unfazed by national fluctuations. And just as the broader market didn't crash as predicted, our local market here in Maine has remained robust, continuing to offer excellent opportunities for both buyers and sellers.

In conclusion, it's important to remember that while forecasts can create a narrative, they don't always pan out. Last year, the predictions of a significant home price depreciation were broadcasted with megaphones. Now, as the market proves these forecasts wrong, the retractions are coming in whispers.

As real estate professionals, it is our responsibility to provide accurate, local, and relevant market analysis. We are here to set the record straight and assure you that the real estate market in Maine, especially York and Cumberland counties, remains strong and resilient.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts