Making Sense Of Home Prices And Mortgage Rates

If you've been giving buying a home some thought, you've probably been frequently monitoring every piece of news about the housing market you can get your hands on. News outlets, social media, chats with your real estate agent, or even casual supermarket conversations - they're all sources of insights and rumors, most likely concerning home prices and mortgage rates.

In order to help you separate the wheat from the chaff, let's focus on the hard data. Here are two essential questions about home prices and mortgage rates that you should be asking:

- What Are the Predicted Trends for Home Prices?

For trustworthy forecasts, you can refer to the Home Price Expectation Survey from Pulsenomics. This survey engages a national panel of over a hundred economists, real estate experts, investment and market strategists.

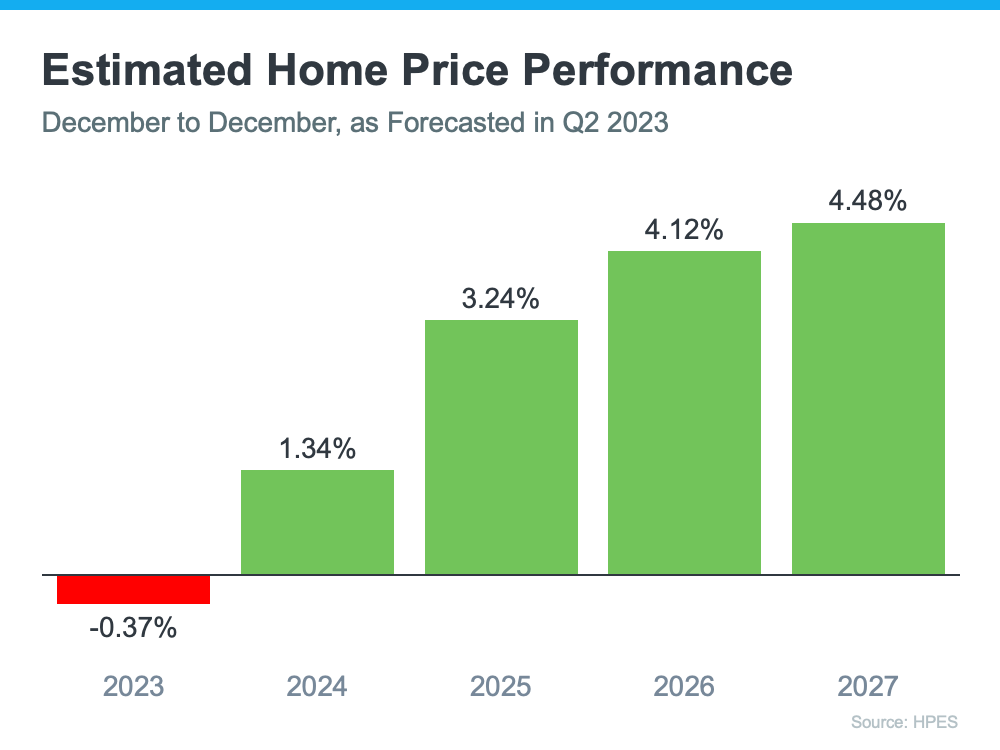

The latest release suggests slight depreciation this year (see red in the graph below). However, bear in mind that the sharpest home price declines are past us, and prices are rising again in many markets. The minor 0.37% depreciation HPES reports for 2023 is far from the crash that some had predicted.

Looking ahead, the green in the graph below indicates that prices have turned the corner and are expected to appreciate in 2024 and beyond. Post-2023, HPES predicts home price appreciation will return to normal levels for several years.

How does this impact you? If you buy a home now, it's likely to increase in value, and you should gain home equity in the forthcoming years. If you delay, these forecasts suggest the home will only cost you more later.

- How Are Mortgage Rates Expected to Shift?

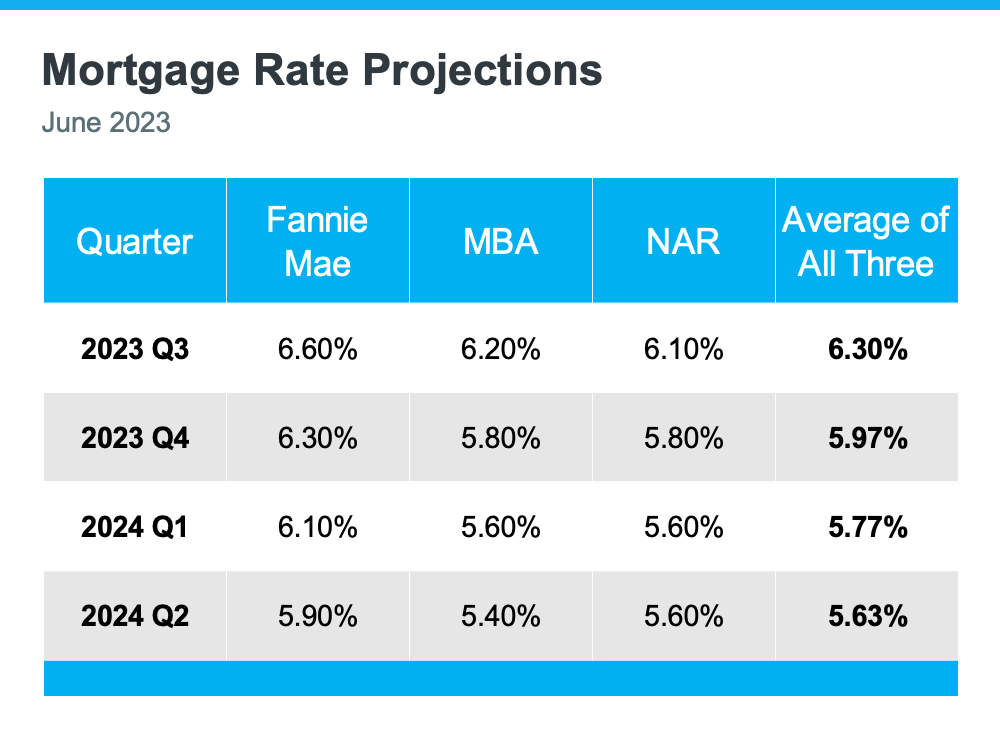

Mortgage rates have increased in the past year due to economic uncertainty, inflation, and more. As inflation appears to be moderating from its peak, it's a promising sign for the market and mortgage rates, which generally fall when inflation cools.

Although it's impossible to predict with absolute certainty where mortgage rates will stand in the future, some experts suggest they may recede slightly over the next quarters and stabilize around roughly 5.5 to 6%.

Here are some scenarios to consider:

- If you buy now and mortgage rates remain stable: You've made a wise move by beating rising home prices.

- If you buy now and mortgage rates decrease (as projected): Still a good decision, as you've purchased before home prices appreciated further. Plus, you can always refinance your home later if rates are lower.

- If you buy now and mortgage rates increase: Congratulations! You've made a fantastic decision by purchasing before both the home price and the mortgage rate escalated.

In Summary

If you're considering buying a home, having factual information about home prices and mortgage rates is crucial. While no one can predict with certainty where they'll end up, expert projections can offer useful insights. Connect with me today for a professional perspective on our local Maine real estate market.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts