Median Sale Price vs. Repeat Sales Price - What's The Difference?

This week, we are anticipating the latest Existing Home Sales (EHS) report from the National Association of Realtors (NAR), a monthly deep dive into the sales volume and price trajectory of pre-owned homes. The forecast suggests a decline in home prices, which may seem perplexing if you've been keeping an eye on recent blogs stating that home prices have bottomed out and are on the rebound.

So, why does this upcoming report suggest a dip in home prices while other analyses indicate an upward trend? The answer lies in the distinct methodologies employed by each report. NAR primarily uses the median sales price, whereas some other sources leverage repeat sales prices. Let's break down these two methods.

The Center for Real Estate Studies at Wichita State University offers a clear explanation of median prices:

"The median sale price measures the 'middle' price of homes that sold, meaning that half of the homes sold for a higher price and half sold for less . . . For example, if more lower-priced homes have sold recently, the median sale price would decline (because the “middle” home is now a lower-priced home), even if the value of each individual home is rising."

On the other hand, Investopedia defines a repeat sales approach as:

"Repeat-sales methods calculate changes in home prices based on sales of the same property, thereby avoiding the problem of trying to account for price differences in homes with varying characteristics."

The Predicament with Today's Median Sales Price

As the quotes above demonstrate, these two methodologies can narrate different market stories. Hence, data based on median price (like EHS) may indicate falling prices, even as a majority of the repeat sales reports portray an appreciating market.

Bill McBride, Author of the Calculated Risk blog, succinctly articulates this difference:

"Median prices are distorted by the mix and repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices."

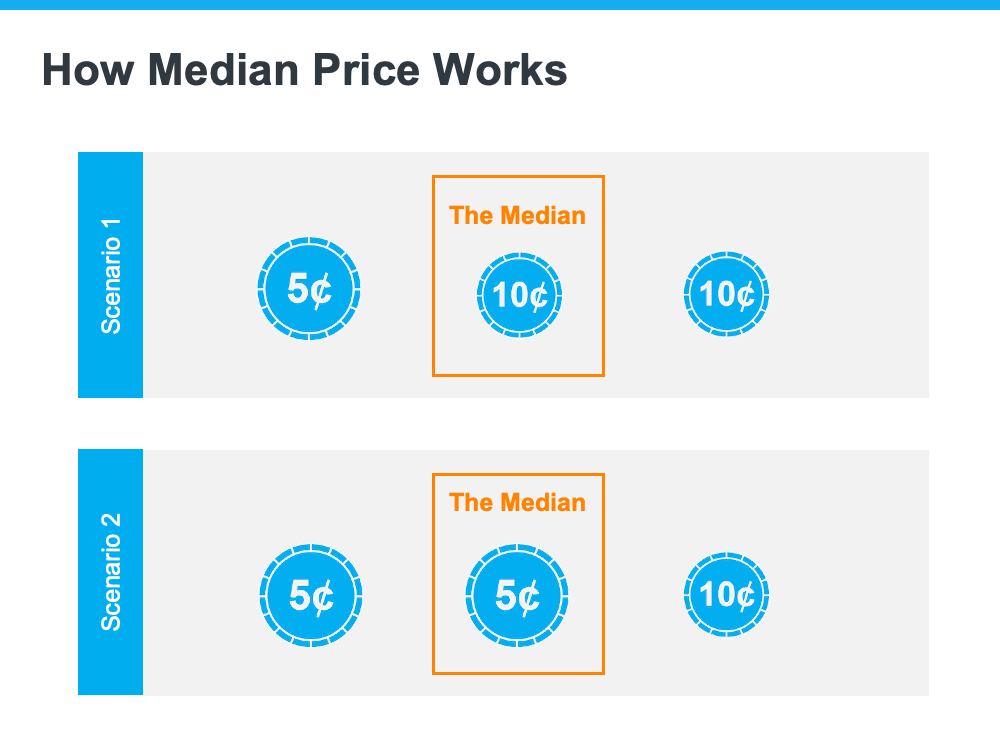

To illustrate this point, consider a simple explanation of median value. If you have one nickel and two dimes, the median value (the middle one) is 10 cents. However, if you have two nickels and one dime, the median value drops to five cents. The value of each coin remains the same; it's the mixture that changes.

The value of each coin remains the same; it's the mixture that changes.

This is why relying on the median home price as a barometer of home value trends can be misleading in the current market. Buyers typically use home prices as a benchmark to align with their budgets. However, the actual purchase often depends on the monthly mortgage payment they can comfortably afford. Higher mortgage rates may necessitate opting for a less expensive home to keep monthly housing costs manageable. The current trend of more 'less-expensive' houses selling is causing the median price to drop, but this doesn't infer a depreciation in the value of any particular house.

So, when you see headlines later this week proclaiming falling home prices, think of the nickel and dime example. A change in the median price doesn't necessarily signify falling home prices; rather, it reflects the mixture of homes being sold, influenced by affordability and current mortgage rates.

Final Thoughts

For a comprehensive understanding of home price trends and reports within the Southern Maine real estate market, let's connect and delve deeper into the data. Remember, a holistic view of the market can provide more insights than individual metrics.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts