Navigating Homeownership: A Spotlight On Southern Maine's Thriving Real Estate Market

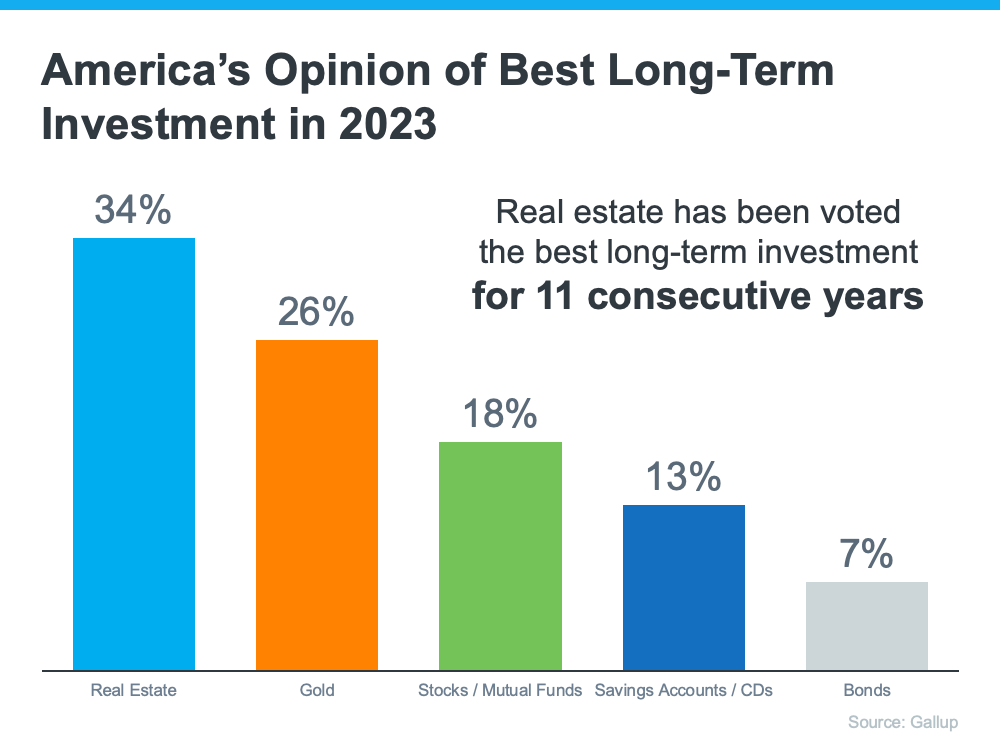

In the midst of the headlines about home prices and fluctuating mortgage rates, you may be wondering whether investing in homeownership still holds merit, especially in the current Maine real estate climate. A recent poll from Gallup might help to resolve your doubts as it reaffirms that yes, indeed, real estate remains a prudent long-term investment choice. For the 11th consecutive year, real estate has outshone other types of investments such as gold, stocks, and bonds (see graph below).

If you're contemplating a home purchase, especially here in the Southern Maine, whether it be in Buxton or Kittery, this poll could serve as a reassuring sign. Despite the ongoing global events, Americans continue to view home ownership as a prudent financial move.

Let's delve a bit deeper into the real estate market in southern Maine. In Cumberland County, home of our biggest city, Portland, the median sale price of a home was $530K last month, an increase of 10.4% since last year. This vibrant market is characterized by homes selling swiftly, usually within just days, and often above the list price.

Traveling slightly south to York County, known for its picturesque beach towns such as Kennebunkport and York, we witness a similar trend. The median sale price here was $480K last month, marking a 14.3% increase from the previous year. Despite homes taking a bit longer to sell in York County, around 26 days on average, the market remains strong with homes frequently selling above list price.

But why do Americans, including those here in Southern Maine, continue to have such positive sentiments about the value of investing in a home?

The rationale is quite straightforward. Purchasing real estate has traditionally been a reliable long-term strategy for wealth accumulation in America. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), emphasizes:

“. . . homeownership is a catalyst for building wealth for people from all walks of life. A monthly mortgage payment is often considered a forced savings account that helps homeowners build a net worth about 40 times higher than that of a renter.”

This occurs as your home appreciates in value over time and as you gradually pay down your mortgage. And since this wealth-building process is gradual, it makes sense to embark on this journey sooner rather than later. If you delay purchasing a home and continue to rent, you'll miss out on the opportunity to channel your monthly housing payments towards building your home equity.

To sum it up, buying a home will certainly be one of your greatest financial decisions that you can make. It's hardly surprising that people still perceive real estate as the best long-term investment. If you're eager to commence your journey towards homeownership, particularly in the thriving real estate markets here in Southern Maine, let's connect today.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts