The ARM Comeback: A Smart Choice In Today's Market?

When someone mentions the 2008 housing crash, many immediately recall the adjustable-rate mortgages (ARMs) that were all the rage back then. Flash forward to today, and we're witnessing the reemergence of ARMs. However, before sounding the alarm bells, let's demystify why ARMs have once again gained traction and why they're no longer the ticking time bombs from yesteryears.

The Rise Of ARMs In The Modern Era

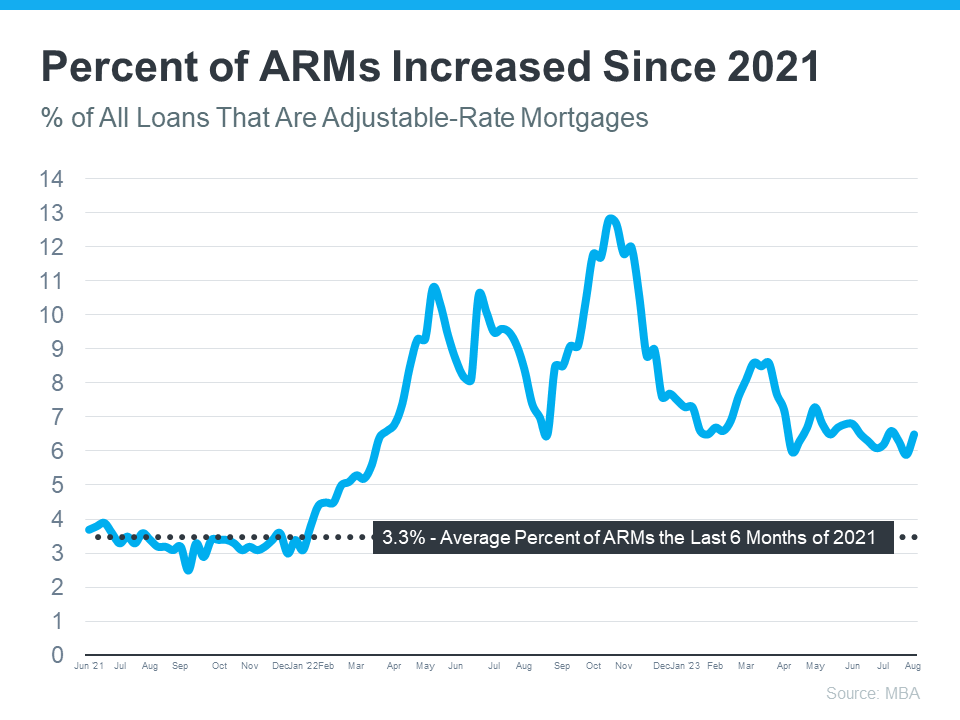

Referencing the Mortgage Bankers Association's (MBA) data, there's a perceptible uptick in the ARM trend:

From a nearly static 3% hold in the market around 2021, the following year witnessed more homebuyers gravitating towards ARMs. The rise in mortgage rates acted as the catalyst. With escalating traditional borrowing costs, homebuyers sought refuge in ARMs, which presented a more cost-effective alternative.

2008 vs. Now: A Whole New ARM Ballgame

It's pivotal to highlight that the current ARMs are nothing like their 2008 predecessors. Before the crash, lenders had a laissez-faire approach, often overlooking crucial checkpoints like verifying a borrower's employment, assets, and income. Consequently, loans were distributed like candy, irrespective of an individual's repayment capacity. This inevitably culminated in a scenario where homeowners defaulted, unable to repay loans they weren't equipped for.

Today, the lending terrain has transformed, informed by past mistakes. Rigorous checks are in place, and only those who qualify under stringent criteria are awarded loans.

Archana Pradhan, a seasoned economist at CoreLogic, offers a vivid contrast:

“Around 60% of Adjustable-Rate Mortgages (ARM) that were originated in 2007 were low- or no-documentation loans . . . Similarly, in 2005, 29% of ARM borrowers had credit scores below 640 . . . Currently, almost all conventional loans, including both ARMs and Fixed-Rate Mortgages, require full documentation, are amortized, and are made to borrowers with credit scores above 640.”

Laurie Goodman, a voice of authority from Urban Institute, underscores the sentiment:

“Today’s Adjustable-Rate Mortgages are no riskier than other mortgage products and their lower monthly payments could increase access to homeownership for more potential buyers.”

The Takeaway

The haunting specter of 2008 ARMs might linger, but today’s variants are fundamentally different, anchored by robust checks and balances.

For those navigating the homebuying maze for the first time and intrigued by contemporary lending avenues, connect with a reputable lender to glean insights and make informed decisions.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts