The Dynamics Of Today's Mortgage Rates

Present-day mortgage rates hold significant importance for prospective homebuyers, particularly in the vibrant real estate market of Southern Maine. Whether you're a first-time buyer or considering selling your current property to upgrade to a more suitable home, you might find yourself contemplating:

- Why Are Mortgage Rates So High?

- When Will Rates Go Back Down?

To help you navigate these questions, let's delve into the dynamics of the mortgage market.

The Intricacies Of High Mortgage Rates

The 30-year fixed-rate mortgage is greatly affected by the supply and demand for mortgage-backed securities (MBS). Investopedia provides a succinct explanation of MBS:

“Mortgage-backed securities (MBS) are investment products similar to bonds. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issued them . . . The investor who buys a mortgage-backed security is essentially lending money to home buyers.”

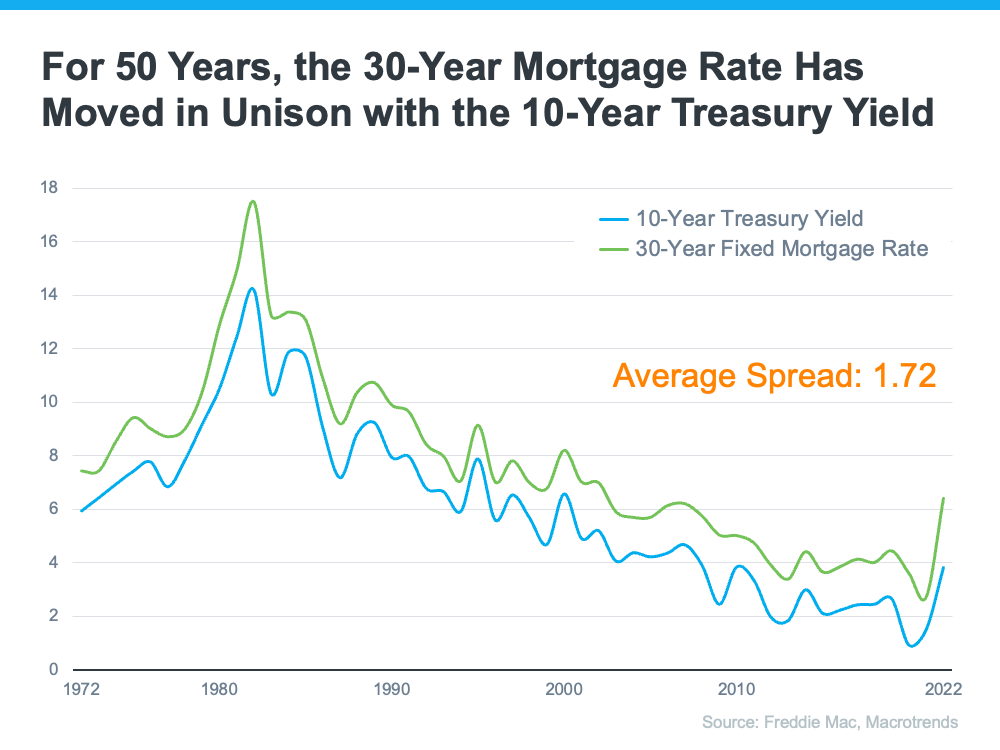

The demand for MBS plays a crucial role in determining the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate. Historically, this spread averages 1.72 (see chart below):

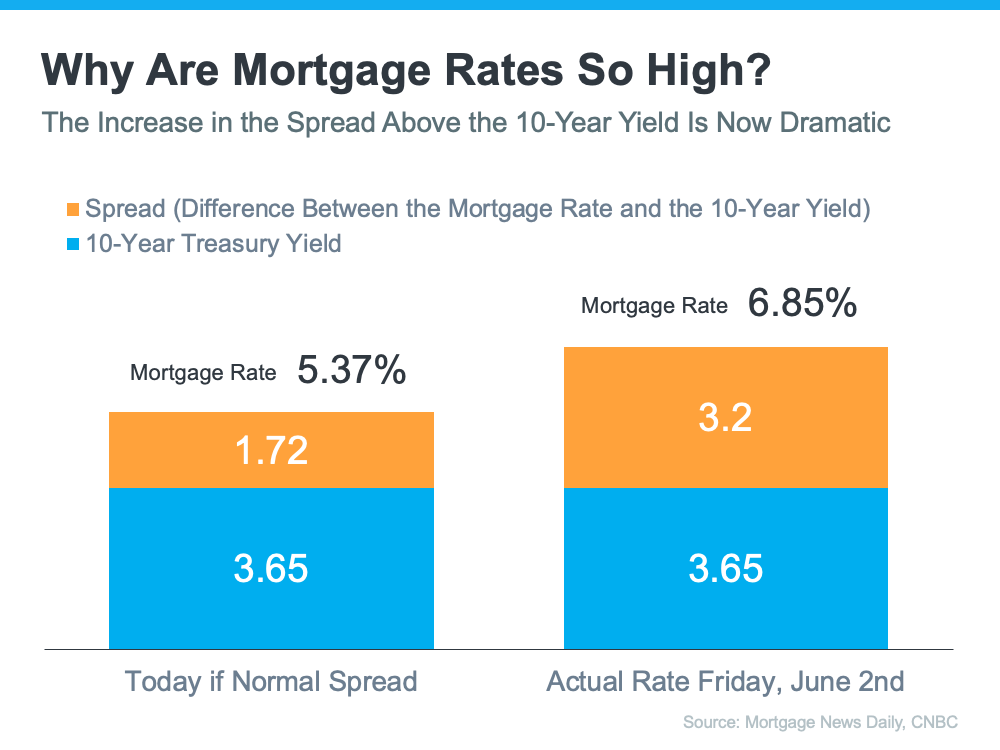

As of last Friday morning, the mortgage rate was recorded at 6.85%, leading to a spread of 3.2% - almost 1.5% above the norm. If the spread were at its historical average, mortgage rates would be 5.37% (3.65% 10-Year Treasury Yield + 1.72 spread).

As of last Friday morning, the mortgage rate was recorded at 6.85%, leading to a spread of 3.2% - almost 1.5% above the norm. If the spread were at its historical average, mortgage rates would be 5.37% (3.65% 10-Year Treasury Yield + 1.72 spread).

Such a large spread is quite extraordinary. As George Ratiu, Chief Economist at Keeping Current Matters (KCM), explains:

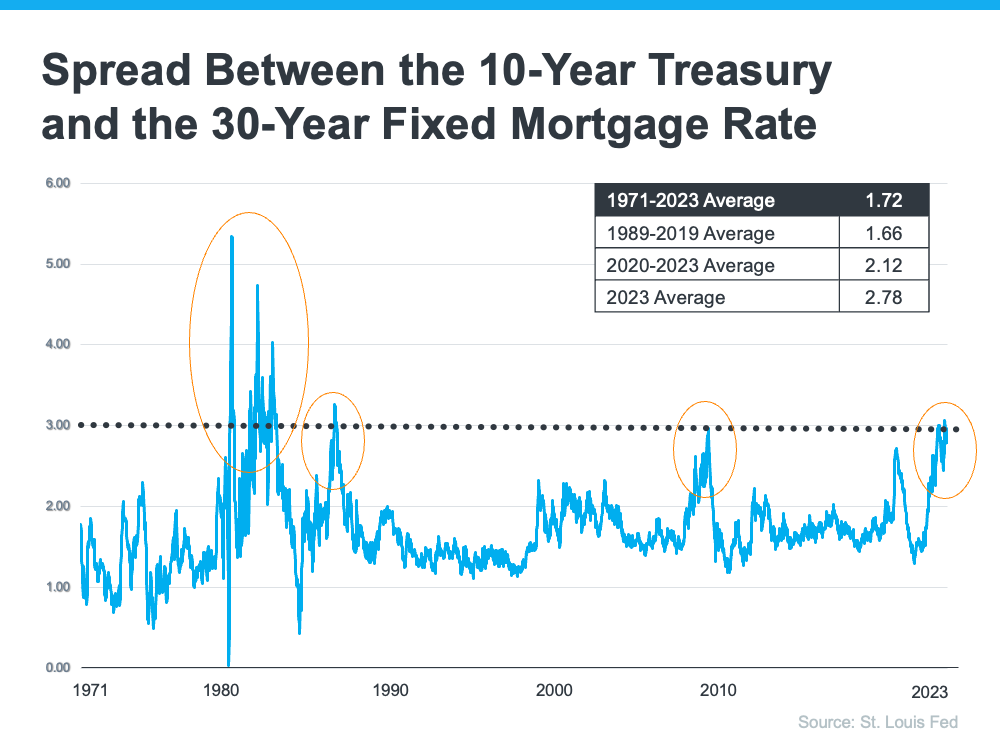

“The only times the spread approached or exceeded 300 basis points were during periods of high inflation or economic volatility, like those seen in the early 1980s or the Great Financial Crisis of 2008-09."

The graph below uses historical data to help illustrate this point by showing the few times the spread has increased to 300 basis points or more:

A closer look at the graph reveals a downward trend following each peak, indicating potential room for mortgage rates to improve today.

So, why is the spread larger, and why are mortgage rates so high today?

The demand for MBS is heavily swayed by the risks associated with investing in them. Presently, such risks are influenced by broader market conditions, including inflation, fear of a potential recession, the Fed’s interest rate hikes aimed at curtailing inflation, and headlines that foster unnecessarily negative narratives about home prices.

In simpler terms, when the risk associated with MBS is low, the demand for MBS is high, leading to lower mortgage rates. Conversely, if the risk is high, the demand for MBS falls, resulting in higher mortgage rates. Currently, demand for MBS is low, leading to high mortgage rates.

Anticipating When Rates Will Go Down

Odeta Kushi, Deputy Chief Economist at First American, offers insight into this question of "when?" in a recent blog:

“It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty. However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

Kushi's analysis suggests that if the spread returns to its historical average, we could see a reduction in mortgage rates. However, predicting when exactly this will happen is uncertain, as it largely depends on how and when market conditions improve.

It's clear that the dynamics of mortgage rates are complex, interwoven with factors such as the demand for Mortgage-Backed Securities (MBS), broader market conditions, and investor perceptions of risk.

The current high mortgage rates in Southern Maine are largely due to these intertwined factors. While there is potential for these rates to decrease, as indicated by the historical pattern of the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate, predicting the exact timing of such a change remains a challenge. However, by understanding the intricacies behind the high mortgage rates, prospective buyers and current homeowners can make more informed decisions about entering or navigating the real estate market.

The key takeaway is to remain vigilant of these factors and trends in order to seize potential opportunities as market conditions evolve.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts