Strength In Numbers – Unraveling Maine's Property Market Dynamics

In the current landscape of real estate, one element that conspicuously stands out is the robustness of the housing market. This is particularly noticeable in southern Maine, specifically in Cumberland and York counties, where the real estate sector is demonstrating unprecedented resilience. In fact, this could arguably be one of the most fundamentally solid housing markets we've witnessed in our lifetime. Let's take a look at two key indicators that substantiate this claim.

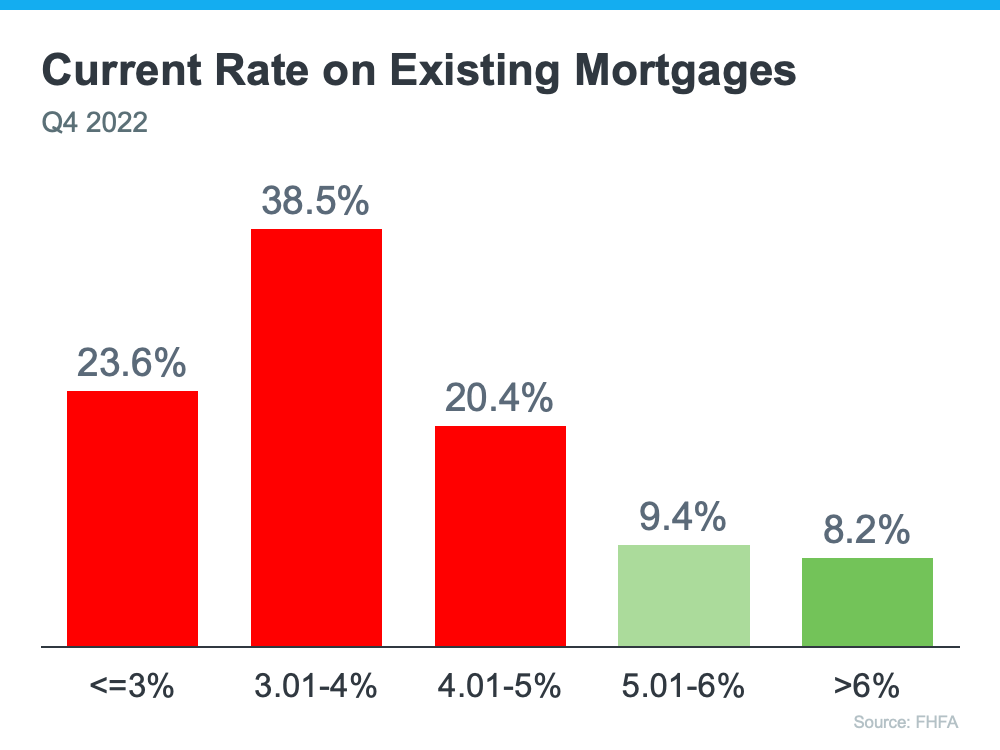

1. Low Mortgage Rates on Existing Mortgages

To begin with, let's assess the mortgage rates on existing properties. According to the Federal Housing Finance Agency (FHFA), as of the end of last year, over 80% of existing mortgages boasted a rate below 5%. This is a considerable figure. Taking it a step further, over half of these mortgages have a rate below 4%.

Amidst media speculation about a potential foreclosure crisis or an increase in homeowners defaulting on their loans, consider the following. Homeowners who enjoy such favorable mortgage rates are likely to strive to maintain their mortgage and retain their homes. This is largely due to the fact that purchasing another smaller house with today's higher mortgage rates or even renting an apartment could be more costly. This reality becomes more apparent when we look at areas like our own Cumberland County where the median sale price of a home was $530K last month, up 10.4% since the previous year.

The strength of today's housing market can be attributed to the high proportion of homeowners with low mortgage rates. This shields the market from a potential crisis precipitated by a surge of foreclosures as witnessed back in 2008.

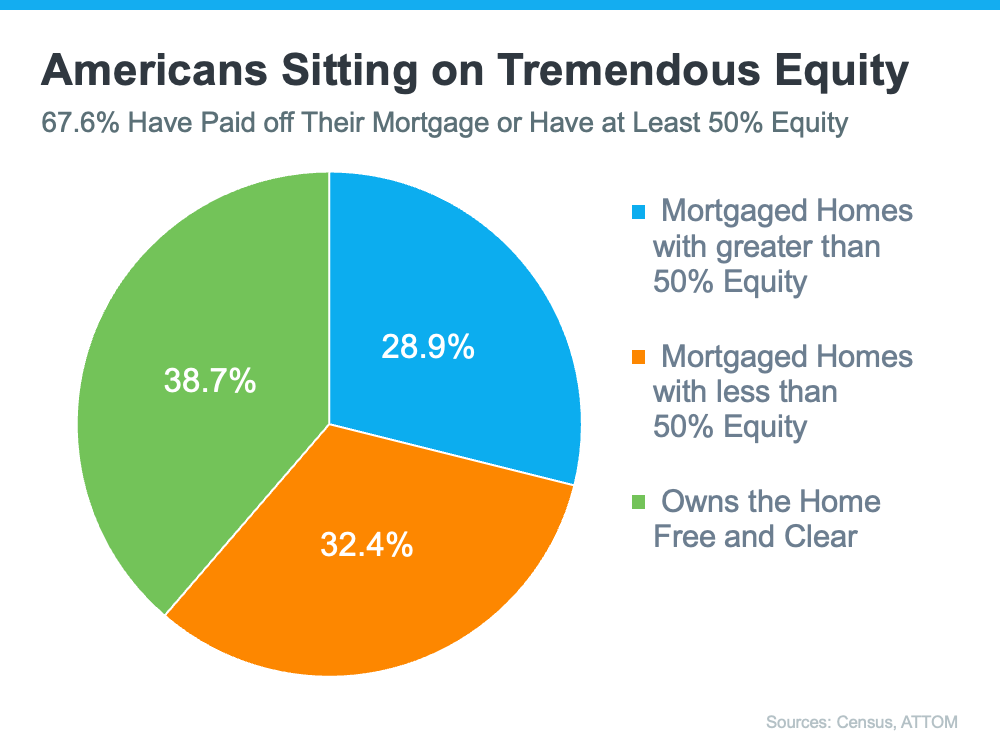

2. High Levels of Homeowner Equity

The second fundamental is the substantial equity that homeowners currently possess. Data from the Census and ATTOM indicates that approximately two-thirds (around 68%) of homeowners have either paid off their mortgage or have at least 50% equity (see chart below):

This is a significant factor because, unlike during the 2008 crisis, homeowners today have accumulated significant equity over the past few years. This helps prevent another influx of distressed properties entering the market, as was the case during the crash. It also fortifies the housing market of today, especially in places like York County where the median sale price of a home last month was $480K, up 14.3% since the previous year.

In Conclusion

The housing market in southern Maine, particularly in Cumberland and York counties, demonstrates the resilience and strength of the real estate sector. The combination of homeowners' determination to preserve their current mortgage rates and the considerable equity they possess forms a robust foundation for the current housing market. This dynamic landscape of real estate in Maine is just another testament to how the situation has fundamentally diverged from what lead to the Great Recession in 2008.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts