The Truth About Rising Foreclosures In Today’s Market

Lately, you may have come across media reports about an increase in foreclosures in the present housing market. These might have caused some concern, especially if you're thinking of buying a home soon. It’s crucial to comprehend the context behind these reports and understand the actual situation.

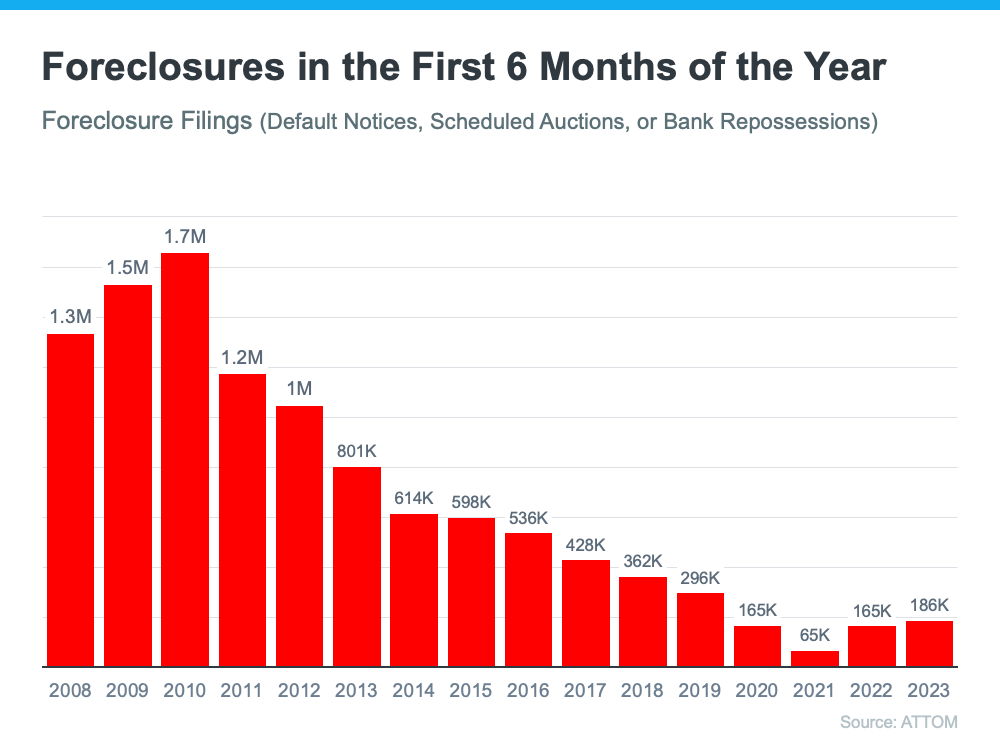

A recent report by property data provider, ATTOM, indicates that foreclosure filings have risen by 2% compared to the last quarter and by 8% compared to the previous year. Though these numbers may sound alarming, they don't signal a crisis in the housing market.

Let’s delve into the details to gain perspective.

A Closer Look At Foreclosure Numbers

In recent years, foreclosure numbers have been at record lows. The forbearance program and other homeowner relief options in 2020 and 2021 helped countless homeowners maintain their properties during a challenging period. Concurrently, the rise in home values provided homeowners with the option to sell their houses and avoid foreclosure by leveraging their equity.

However, with the end of the government’s moratorium, a rise in foreclosures was expected. Clare Trapasso, Executive News Editor at Realtor.com, provides context:

“Many of these foreclosures would have occurred during the pandemic, but were put off due to federal, state, and local foreclosure moratoriums designed to keep people in their homes . . . Real estate experts have stressed that this isn’t a repeat of the Great Recession. It’s not that scores of homeowners suddenly can’t afford their mortgage payments. Rather, many lenders are now catching up. The foreclosures would have happened during the pandemic if moratoriums hadn’t halted the proceedings.”

Bankrate provides further insights:

“In the years after the housing crash, millions of foreclosures flooded the housing market, depressing prices. That’s not the case now. Most homeowners have a comfortable equity cushion in their homes. Lenders weren’t filing default notices during the height of the pandemic, pushing foreclosures to record lows in 2020. And while there has been a slight uptick in foreclosures since then, it’s nothing like it was.”

The graph below illustrates how different the situation is now compared to the housing crash, using data on foreclosure filings for the first half of each year since 2008.

Today, foreclosures are considerably below the record-high number that was reported during the housing market crash.

Bottom Line

Considering the data in context is more important than ever. While the housing market is experiencing an expected rise in foreclosures, it’s nowhere near the crisis levels seen during the housing bubble burst. These increases won't lead to a crash in home prices.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts