Unlocking Homeownership: Down Payment Myths & Options in Southern Maine

“One of the biggest misconceptions among housing consumers is what the typical down payment is and what amount is needed to enter homeownership.”

A survey by Freddie Mac reinforces this point:

“. . . nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.”

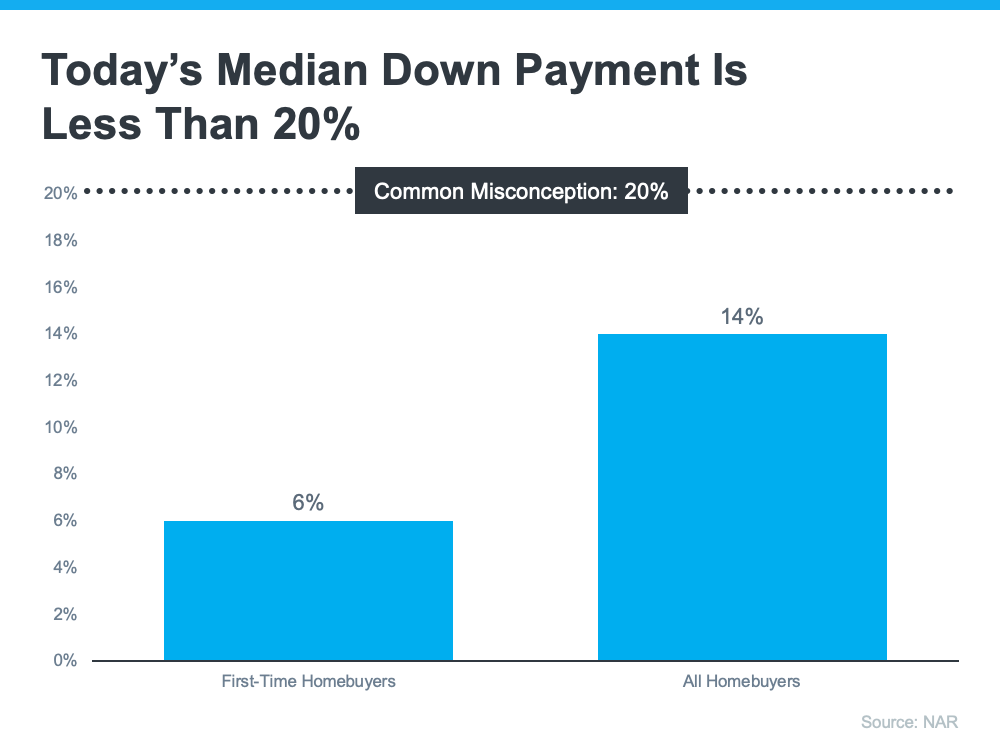

Here's the reality: a 20% down payment isn't mandatory. You could be much closer to your dream of homeownership than you realize. According to NAR, the median down payment hasn't exceeded 20% since 2005. Today, the average down payment for all homebuyers is only around 14%, and it's even lower for first-time homebuyers at 6% to 7%. This could mean that your home ownership dreams are closer than you initially thought.

Understanding Your Options

Alongside the common misconceptions about the necessary down payment, there are also misunderstandings about down payment assistance programs. For example, many people are under the impression that these programs are only available to first-time homebuyers. While first-time buyers indeed have many options, there are also opportunities for repeat buyers.

Over 2,000 homebuyer assistance programs exist in the U.S., and many of these are designed to help with down payments. According to Down Payment Resource:

“You don’t have to be a first-time buyer. Over 38% of all programs are for repeat homebuyers who have owned a home in the last 3 years.”

Diving even deeper, there are various types of down payment assistance programs, including grants, loans, deferred loans, and forgivable loans. Each type has its unique features and benefits, and they can significantly reduce the financial burden of a down payment.

Some of the most common loan types, such as FHA loans with down payments of 3.5% as well as options like VA loans and USDA loans providing 0% down payment loans, are available to many borrowers across the country making homeownership a possibility where it may not have been before.

If you're interested in learning more about these assistance programs, resources like Down Payment Resource provide valuable information. It's also crucial to partner with a trusted lender to understand what you qualify for in your homebuying journey.

In Conclusion

Remember, a 20% down payment isn't always required. If you're looking to purchase a home this year, let's start a conversation about your homebuying goals. With a clear understanding of the options available to you, you could soon be on your way to owning your dream home.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts