Unraveling The Home Equity Equation

You might be seeing news discussing a decrease in homeowner equity. It's crucial to note that equity is closely linked to the value of homes. When home prices increase, so does equity, and vice versa. Let's look at how this dynamic has unfolded recently.

During the 'unicorn' years, home prices surged rapidly, significantly increasing homeowners' equity. However, these 'unicorn' years were not sustainable in the long run. As expected, the market began to moderate, which was evident last fall and winter.

Home prices experienced a minor decline in the second half of 2022, and this impacted equity. According to the latest report from CoreLogic, there was a 0.7% decrease in homeowner equity over the past year. However, the media reporting on this change isn't providing the full context. In reality, while the depreciation of home prices during the latter half of last year led to a drop in equity, homeowners still hold near-record amounts of equity.

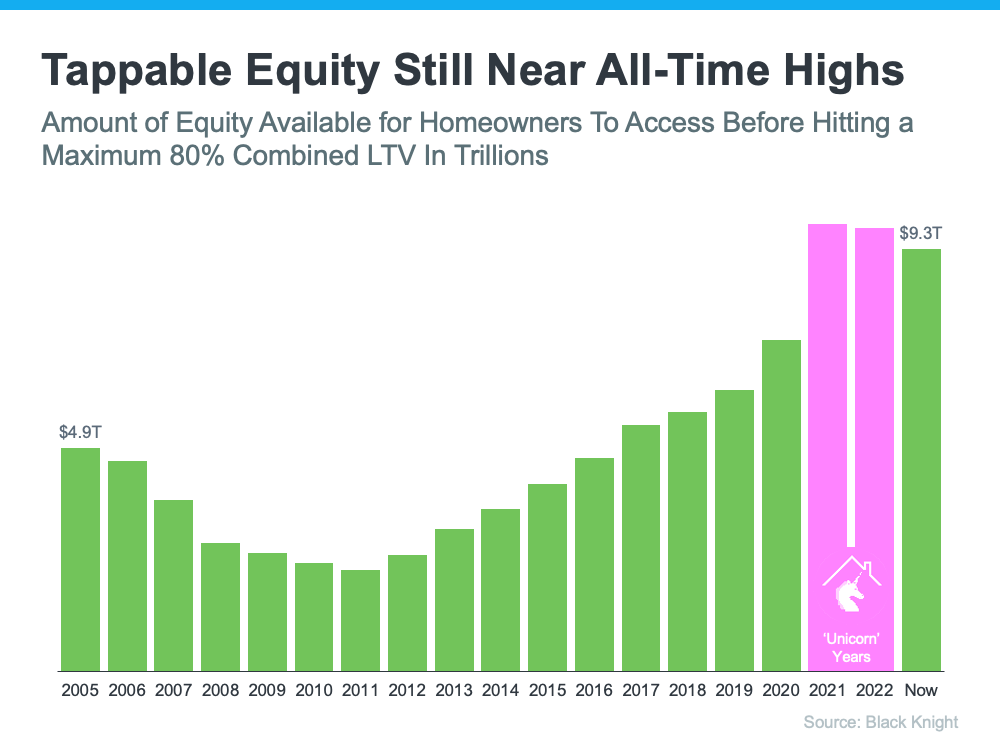

The graph below offers a clear picture by examining the total amount of tappable equity in the country dating back to 2005. Tappable equity is the equity that homeowners can access without exceeding an 80% loan-to-value ratio (LTV). The data shows a substantial equity surge during the 'unicorn' years due to the rapid appreciation of home prices (indicated in pink in the graph below).

But here's the critical point to understand – despite a small dip, total homeowner equity remains significantly higher than pre-'unicorn' years levels.

There's even more positive news. Recent reports on home prices indicate that the worst declines are behind us, and prices have started to rise again. Selma Hepp, Chief Economist at CoreLogic, explains:

"Home equity trends closely follow home price changes. As a result, while the average amount of equity declined from a year ago, it increased from the fourth quarter of 2022, as monthly home prices growth accelerated in early 2023."

The final part of Hepp's statement is particularly important and is often overlooked in news reports. Experts predict that home prices will appreciate at a more typical rate over the next year, emphasizing the positive trend we're already witnessing. In the same report, Hepp states:

"The average U.S. homeowner now has more than $274,000 in equity – up significantly from $182,000 before the pandemic. Also, while homeowners in some areas of the country who bought a property last spring have no equity as a result of price losses, forecasted home price appreciation over the next year should help many borrowers regain some of that lost equity."

Even though Odeta Kushi, Deputy Chief Economist at First American, references a slightly different number, Kushi further confirms the fact that homeowners currently have substantial equity:

"Homeowners today have an average of $302,000 in equity in their homes."

If you've owned your home for several years, you likely have significantly more equity than before the 'unicorn' years. If you've owned your home for a year or less, the forecast of more typical price appreciation over the next year should mean your equity is already rebounding.

Bottom Line

The context is everything when interpreting headlines. While homeowner equity has decreased slightly from its highs last year, it's still near those all-time highs. Let's connect so you can get the accurate information you need from an expert who's here to assist you with your move this year.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts