Why Homeownership Still Matters In The American Dream

The American Dream is a unique concept, interpreted differently by everyone. For many, it symbolizes success, freedom, and prosperity - all of which can be achieved through homeownership.

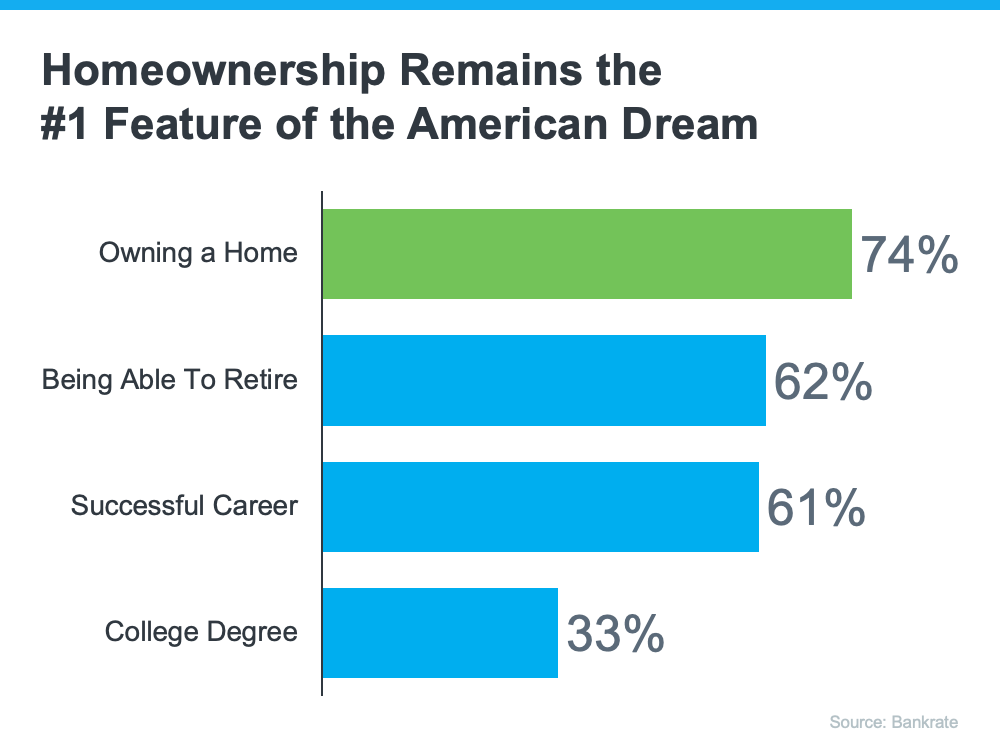

A recent survey conducted by Bankrate asked participants to identify which achievements best symbolize the American Dream. The results (refer to graph below) reveal that homeownership remains a significant goal for many Americans, surpassing milestones such as retirement, having a successful career, and earning a college degree.

In understanding why homeownership holds such value, a recent report from MYND provides insight:

“. . . nearly two-thirds of Americans (65%) see homeownership as a means of building intergenerational wealth.”

When you own a home, you grow your equity over time through your mortgage payments and home price appreciation. This progression is pivotal for establishing intergenerational wealth and long-term financial stability.

Furthermore, a Fannie Mae report underscores the value homeownership can bring:

“Most consumers (87%) believe owning a home is important to ‘live the good life.’ . . . Notably, significantly more see ‘having less stress’ as a benefit achieved by owning than renting.”

This sentiment may resonate particularly now, as owning a home with a fixed-rate mortgage helps stabilize your most substantial monthly expense (housing cost), mitigating the effects of inflation.

What Does This Mean for You?

Despite the challenges of higher mortgage rates and home prices, if the time is right for you, the rewards of homeownership await. Buying a home in Southern Maine, for example, offers not only a stable housing expense but also an opportunity to enjoy the beauty and unique lifestyle this region provides.

In Conclusion

Buying a home embodies the essence of the American Dream - a significant and empowering decision. If your dream is to own a home in Southern Maine this year, let's connect and begin the journey.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts