Y-O-Y And M-O-M Comparisons In Southern Maine's Real Estate Market

Deciphering media narratives surrounding home prices can be a complex task. The main source of confusion stems from the data being used and the aspects they choose to highlight. Home prices, especially in dynamic markets such as those found in Cumberland and York Counties of Southern Maine, are often compared using two distinct methodologies: year-over-year (Y-O-Y) and month-over-month (M-O-M) comparisons. Here's a deep dive into each.

Year-over-Year (Y-O-Y):

This method measures the change in home prices from the same month or quarter in the previous year. For instance, when evaluating Y-O-Y home prices for April 2023, you would contrast them with the prices for April 2022.

Y-O-Y comparisons concentrate on changes over a one-year period, offering a broad overview of long-term trends. Such trends are critical for assessing annual growth rates and determining whether the market is generally appreciating or depreciating. As of April 2023, Cumberland County home prices increased by 10.4% compared to the previous year, while York County experienced a 14.3% rise.

Month-over-Month (M-O-M):

This approach measures the change in home prices from one month to the next. For example, when comparing M-O-M home prices for April 2023, you would contrast them with the prices for March 2023.

M-O-M comparisons scrutinize changes within a single month, providing a more immediate snapshot of short-term movements and price fluctuations. They are often instrumental in tracking immediate shifts in demand and supply, seasonal trends, or the impact of specific events on the housing market.

The critical difference between Y-O-Y and M-O-M comparisons is the time frame being examined. Both methodologies have their own merits and serve different purposes depending on the specific analysis needed.

Why Is This Distinction So Important Right Now?

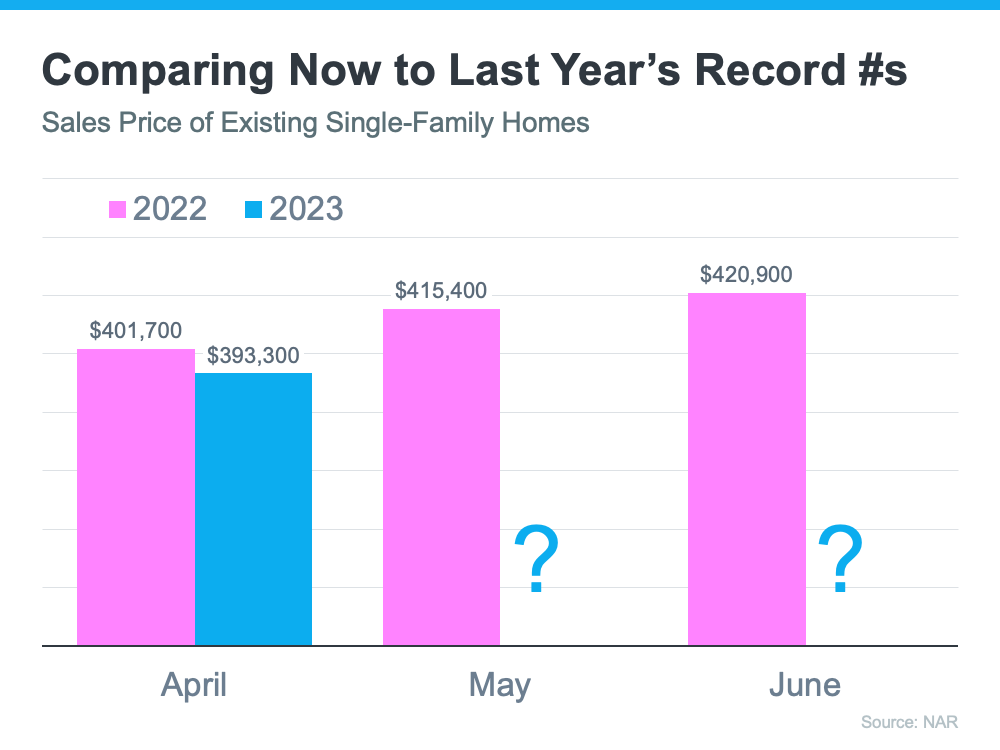

As we venture into a period where home prices might potentially be lower than they were in the same month the previous year, it's crucial to understand these differences. April, May, and June of 2022 were three of the best months for home prices in the history of the American housing market, including the booming markets of Southern Maine. This year, those same months might not measure up. Therefore, the Y-O-Y comparison will likely show that values are depreciating. April's numbers seem to suggest that this is what we can anticipate in the months ahead (see graph below):

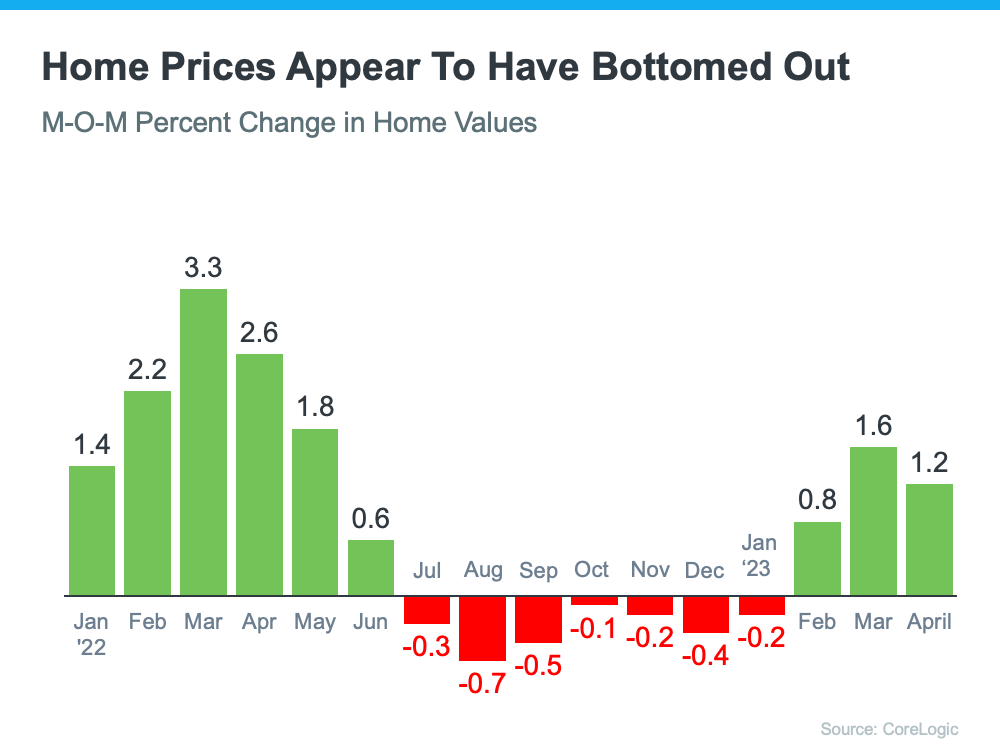

Such a trend might result in alarming headlines declaring that home values are plummeting. While this will be accurate on a Y-O-Y basis, and may lead many to believe that home values are currently spiraling downward, a closer examination of M-O-M home prices reveals a different picture. We can see that prices have actually been appreciating for the last several months. The M-O-M figures more accurately reflect what’s truly happening with home values: after several months of depreciation, it appears we’ve hit bottom and are bouncing back.

Take a look at this example of M-O-M home price movements for the last 16 months from the CoreLogic Home Price Insights report (see graph below):

Why Does This Matter to You?

If you’re hearing negative headlines about home prices, remember they may not be paintingthe full picture. For the next few months, we’ll be comparing prices to last year’s record peak, which may make the Y-O-Y comparison seem more negative. But, if we look at the more immediate, M-O-M trends, we can see home prices are actually on the rise.

There’s an advantage to buying a home now. You’ll buy at a discount from last year’s price and before prices start to pick up even more momentum. It's known as “buying at the bottom,” and it's a favorable strategy for prospective homeowners.

Bottom Line

If you have questions about what’s happening with home prices in the Southern Maine area, particularly in Cumberland and York counties, or if you’re ready to buy before prices climb higher, let’s connect. As a seasoned expert in the Maine real estate market, I can provide the context and understanding you need to make an informed decision. Contact me today to begin your journey in this vibrant real estate market.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts