Your Home & Net Worth

Purchasing a house has become an increasingly popular way to achieve financial security and generate wealth. As per Freddie Mac, buying a home is a key aspect of wealth creation and financial stability, thanks to the equity built through monthly payments and home price appreciation.

With the Maine real estate market experiencing growth, now is an excellent time to consider buying a home. The best way to determine whether homeownership is a good fit for you is by consulting a reputable real estate professional and an experienced lender.

Home Equity: Fueling The American Dream

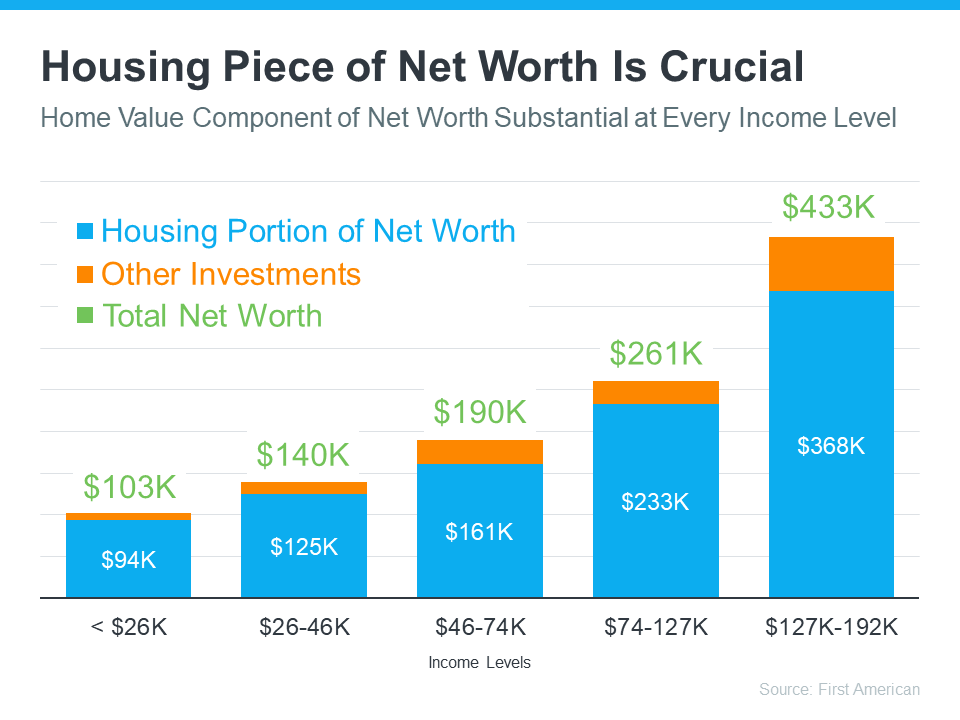

Most people are unaware of how much of their net worth comes from owning a home. The National Association of Realtors (NAR) indicates that homeownership is the primary source of wealth for many families. The median value of a primary residence is roughly ten times greater than the median value of financial assets held by families. Housing equity is established via price appreciation and mortgage repayment, resulting in significant gains in net worth.

In other words, homeownership is more effective at building wealth for the average household than any other method. According to First American data, this is accurate across all income levels (refer to the chart below):

It's Pretty Clear

Owning a house, regardless of your income level, has a significant financial impact, providing stability and a way to create wealth. Connect with me today to begin investing in homeownership and reaping its benefits.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts