Seasonality And Home Prices: Understanding The Rhythm Of Real Estate

Whether you are planning to buy or sell a property, understanding home prices is likely a top concern. It's not surprising if you are finding it hard to get a clear picture, given the confusing way headlines are addressing the issue.

Many media outlets frame their narratives negatively by comparing the current statistics to the past few years. However, comparing the current year to the 'unicorn' years – when home prices soared to record highs – can be misleading. As home prices begin to stabilize, they are presented as a cause for concern, generating unnecessary fear. But, in reality, the steepest declines in home prices are already in the rearview mirror. The current trend signals a return to more normal home price appreciation.

To help clarify, let's focus on what's typical for the market and disregard the last few years, as they were outliers.

Understanding The Seasonality Of Real Estate

The housing market experiences predictable highs and lows each year. Spring is the peak homebuying season with high activity levels, which usually continues into the summer. As the cooler months approach, the market activity decreases, and consequently, so do home prices.

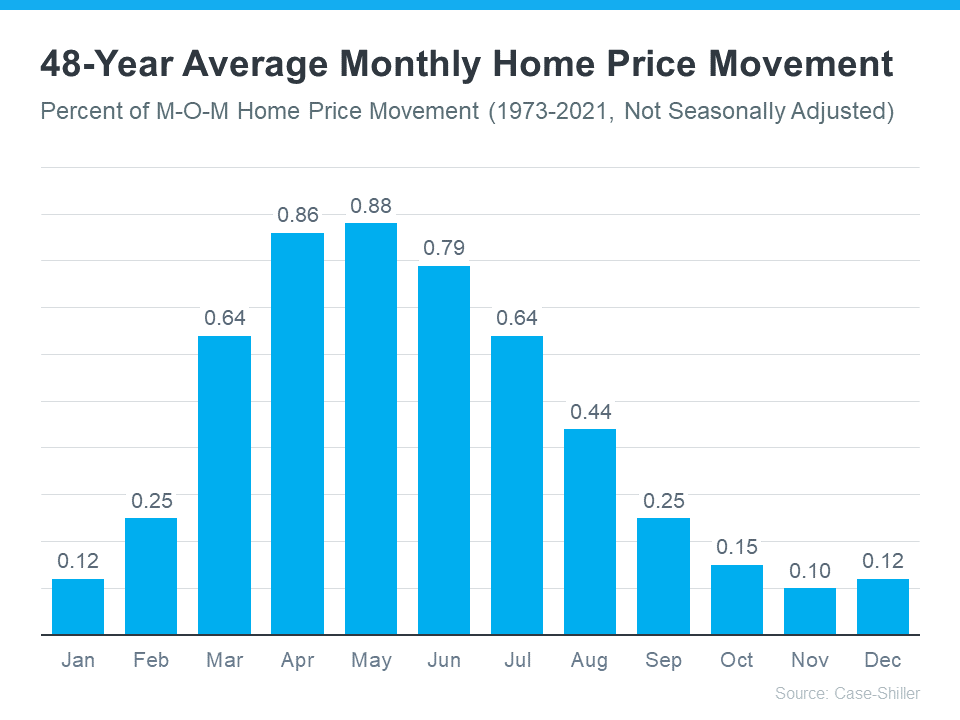

Historically, before the recent unusual years, there was a consistent long-term home price trend. The graph below, using data from Case-Shiller, illustrates typical monthly home price movement from 1973 through 2021:

As the data shows, at the start of the year, home prices appreciate at a moderate pace, reflecting less activity in the colder months. As the market transitions into the peak homebuying season in the spring, activity increases, causing a more significant appreciation in home prices. By fall and winter, activity reduces again, slowing the rate of price growth, but prices typically continue to appreciate.

Understanding This Trend Is Crucial

In the coming months, as the housing market settles into a more predictable rhythm, there will be more headlines that may misinterpret or misrepresent the home price trends. These headlines may employ terms like:

- Appreciation: An increase in prices.

- Deceleration of appreciation: Prices continue to appreciate, but at a slower pace.

- Depreciation: A decrease in prices.

These headlines might misconstrue the typical slowing of home price growth (deceleration of appreciation) that occurs in the fall and winter as a drop in prices (depreciation). Don't let these headlines cause confusion or fear. Remember, a deceleration of appreciation or slowing home price growth is typical as the year progresses.

Bottom Line

If you have any concerns about local home price trends, please get in touch.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts