The Fed's Role In Your Homeownership Dream

For many, the world of the Federal Reserve (often simply called "the Fed") and its effects on the housing market can seem enigmatic. How does a decision by the Fed, situated in Washington D.C., influence your dream of purchasing a home in your locale? Let’s demystify this.

The Federal Reserve’s Battle Against Inflation

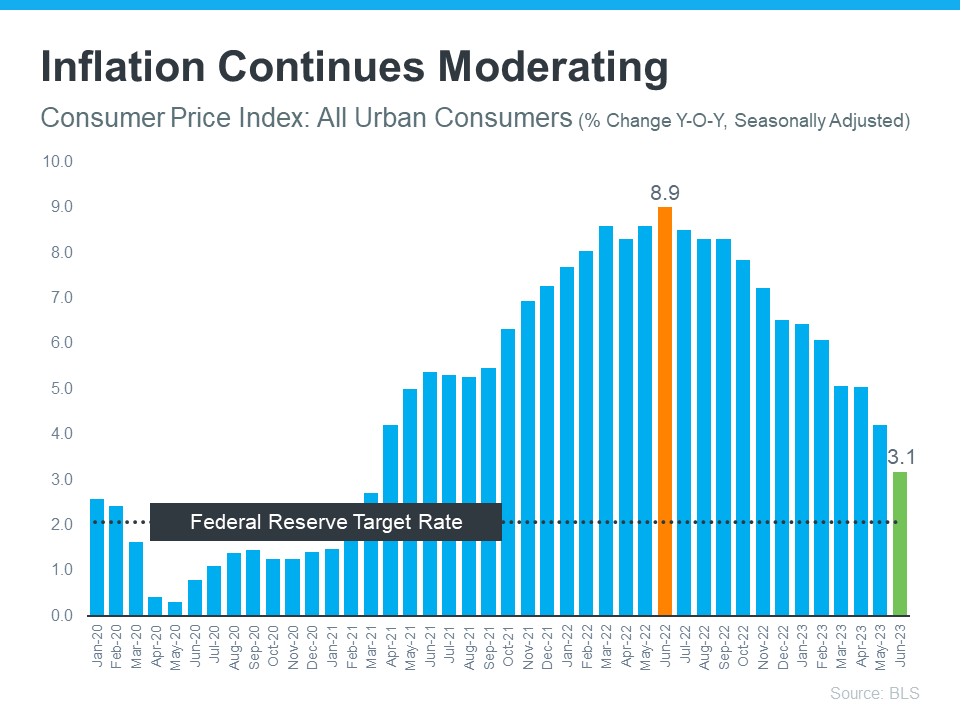

The Federal Reserve constantly grapples with inflation. Even if inflation has decelerated for 12 consecutive months, it's lingering above the Fed’s ideal threshold of 2%.

While your intuition might be that the Fed should slow down as they're nearing their target, their strategy is preventive. Halting abruptly could trigger a rapid surge in inflation. As a result, the Fed recently bumped up the Federal Funds Rate. Jerome Powell, the Fed's Chairman, elucidated:

“We remain committed to bringing inflation back to our 2 percent goal and to keeping longer-term inflation expectations well anchored.”

Greg McBride, an authoritative voice from Bankrate, explains the juxtaposition of persistent inflation and a flourishing economy, which propelled the Fed's decision:

“Inflation remains stubbornly high. The economy has been remarkably resilient, the labor market is still robust, but that may be contributing to the stubbornly high inflation. So, Fed has to pump the brakes a bit more.”

The Fed's Rate And Its Ripple Effect On Mortgages

Though the Federal Funds Rate's hike doesn’t automatically govern mortgage rates, it casts a shadow. A recent article from Fortune helps shed light:

“The federal funds rate is an interest rate that banks charge other banks when they lend one another money . . . When inflation is running high, the Fed will increase rates to increase the cost of borrowing and slow down the economy. When it’s too low, they’ll lower rates to stimulate the economy and get things moving again.””

Connecting The Dots: How Does This Impact You?

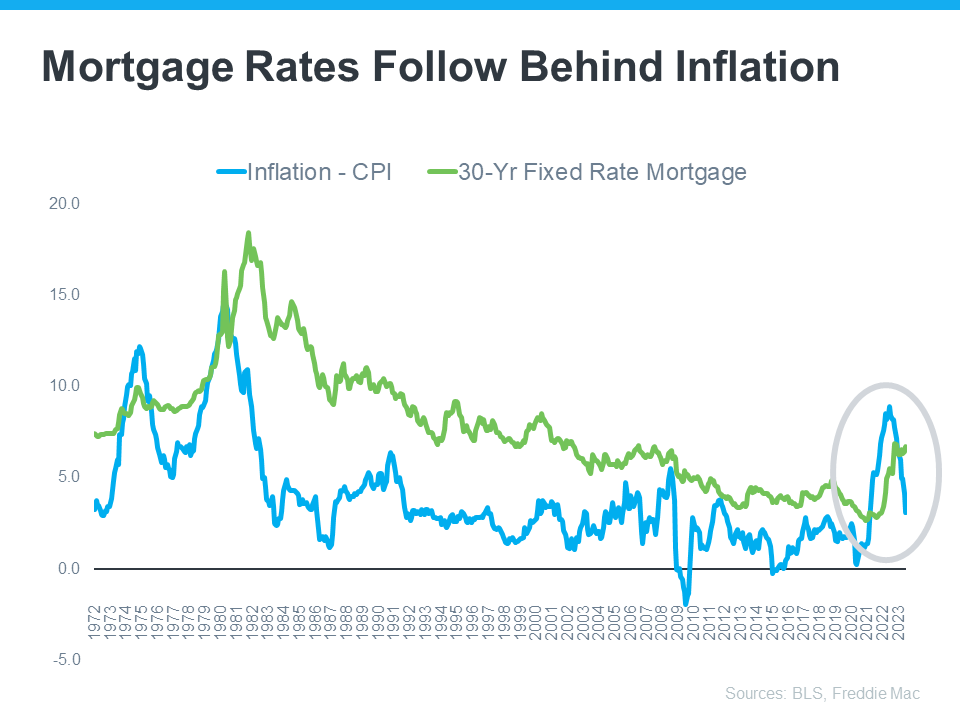

When inflation spikes, mortgage rates generally climb. Yet, if the Fed triumphs in reducing inflation, it could translate into plummeting mortgage rates, sweetening your home-buying prospects.

Illustratively, a graph shows a parallel between dropping inflation and descending mortgage rates.

As the data above shows, inflation (shown in the blue trend line) is slowly coming down and, based on historical trends, mortgage rates (shown in the green trend line) are likely to follow. McBride says this about the future of mortgage rates:

“With the backdrop of easing inflation pressures, we should see more consistent declines in mortgage rates as the year progresses, particularly if the economy and labor market slow noticeably.”

In A Nutshell

Your mortgage rate is tied to the ebb and flow of inflation. If inflation retracts, expect mortgage rates to dip. Let's engage in a conversation to keep you abreast of these shifts and how they shape your home-buying journey.

Categories

- All Blogs (134)

- Baby Boomers (3)

- Buying Myths (27)

- Demographics (8)

- Distressed Properties (3)

- Down Payments (4)

- Efficient Homes (1)

- First Time Home Buyers (44)

- For Buyers (85)

- For Sellers (73)

- Foreclosures (8)

- FSBO (3)

- Home Equity (4)

- Home Ownership Programs (1)

- Housing Market Update (73)

- Infographics (22)

- Interest Rates (23)

- Investing (1)

- Market Trends (1)

- Millennials (4)

- Move-Up Buyers (36)

- New Construction (3)

- Pricing (32)

- Real Estate Crash (15)

- Rent vs. Buy (8)

- Retirement (1)

- Selling Myths (31)

Recent Posts